Many people think that the ONLY WAY to become rich is to win a lottery. The truth is winning a lottery is the MOST difficult way to become rich… BECAUSE… the guy who won it will NEVER be able to win it again in his entire life.

But the truth is the easiest way to win 1 crores is by investing in the BEST companies in SUNRISE Industries.

Table of Contents:

1. History of Suzlon

2. In 2007 Suzlon bought Senvion/REpower

3. Lehman Brothers crash

4. The fall of Suzlon

5. Suzlon turns the corner

6. Tulsi Tanti passes away

7. Suzlon Rights Issue

8. Is Suzlon a Multibagger?

9. List of Wind Energy Companies in India

10. Suzlon the Penny stock

11. Cavet Emptor: Be aware of Stock Market Risk

12. But is Suzlon involved in SUNRISE industry or in SunSet Industry?

13. Stock analysts good at Bookish Knowledge

14. Examples of wrong business models in India

15. Evaluating Suzlon Energy business

16. Servicing & Maintenance Niche & operating Cash flow

17. Suzlon Energy is almost like a monopoly

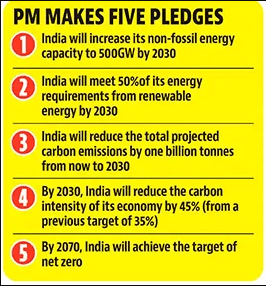

18. India’s Renewable Energy Target – 500 Gw

19. World’s Renewable Energy Requirement

20. India’s Renewable Energy requirement

21. Why will India need so much NEW electricity

22. Suzlon Energy share price can touch Rs 4,590 in the year 2030

23. Why Private companies in India will not manufacture Hydrogen or Semiconductor unless government companies gets into manufacturing them.

Read on and see if what I say make any sense… take action & invest if you think It makes sense.

History of Suzlon: Suzlon Energy has been the favorite of a lot of Indians in the Share Market.

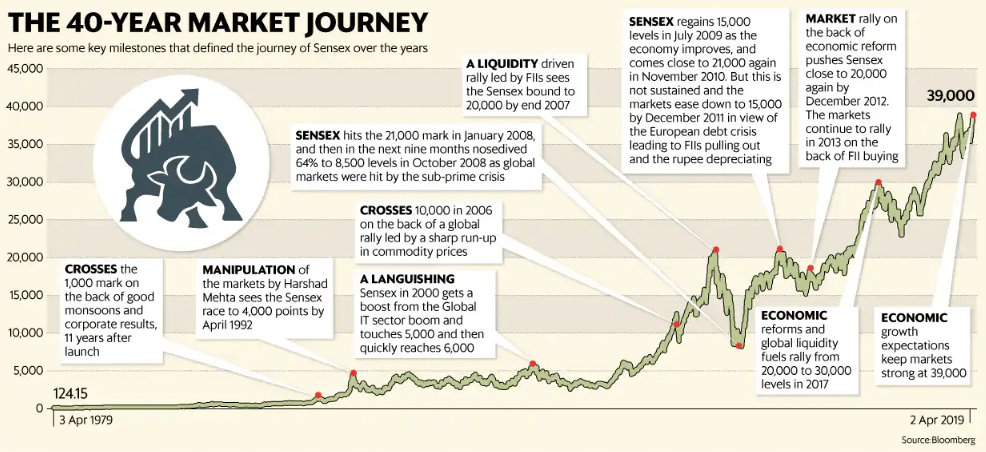

In 2007 Suzlon had reached its pinnacle and was the 5th largest Wind Energy company in the entire world and its share price was Rs 459.

Then Suzlon did what every company would try to do… expand its market in other countries… It entered the European Market in 2007 by buying couple of European companies.

In 2007 Suzlon bought Senvion (then called REpower Systems), for €1.4 billion, mostly with borrowed money. On top of that Suzlon couldn’t use cash reserves of Senvion in spite of buying it. European laws. This was kind of a double whammy.

15 September… 2008 Lehman Brothers filed for bankruptcy… overnight the credit flow stopped completely… and these big wind-infrastructure projects need big credit… tripple whammy… the …

rug was pulled from under Suzlon.

5th hull of the Titanic was breached… and it sank… into the depths of icey dark blue stock market ocean.

Big projects were less after Lehman Brothers crash… credit was still tight… and Suzlon Energy Share started to sink… it fell from Rs 459… to Rs200 … then to Rs 170… then to Rs 150 … to Rs 85… to Rs 40… before touching the single digit abyss from where most stock market scripts never comes back.

By 31 Oct 2008 Suzlon Energy share was trading at Rs 40.

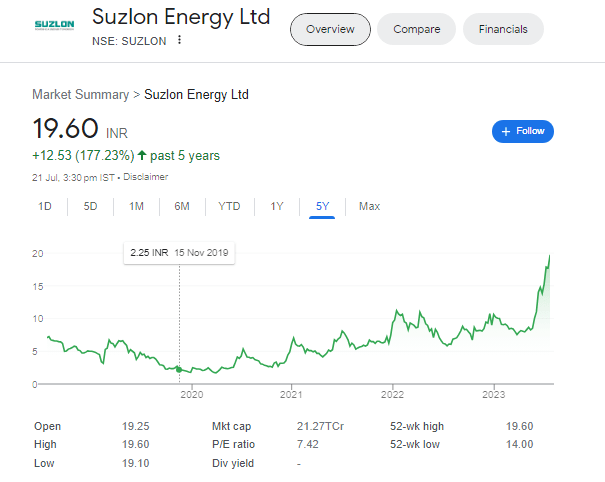

On 15 Nov 2019 Suzlon Energy share was trading at 2.25.

One by one… Suzlon started to sell off its assets outside India to repay its Senvion debts… Retail investors were frustrated at this almost daily-sale of some or the other subsidiary company of Suzlon.

In November 2009, the company decided to sell 35% stake of Hansen for $370 million..

October 2011, Suzlon sold its remaining 26.06% stake in Hansen Transmissions International NV to ZF Friedrichshafen AG for ₹8.9 billion (US$110 million).

2012 Sold China manufacturing unit to China Power New Energy Development Company Limited for 3.4 billion rupees ($60 million).

22 January 2015, Suzlon announced the sale of Senvion SE, its wholly owned subsidiary, to Centerbridge Partners, a private equity firm in a deal valued at just ₹ 7200 crores.

Suzlon tired everything it could to save Senvion because Senvion was a profitable company… but lenders would have nothing they wanted to sell Suzlon’s best assets to get back their funds…

Suzlon tried to take Senvion public… or even sell it at a fair price … but did not succeed… Lehman Bros had crashed the western markets… Those with money wanted to extract as much flesh from a dying prey… so they wanted Senvion at a huge discount.

Suzlon had no option but to exit the European market taking a Euro 1 billion loss... not Rupee billion… but Euro billion!

By 2018 Suzlon Energy share was trading in single digits... Nobody wanted Suzlon Shares… people (small retail investors) who had trusted Suzlon with their hard earned money were frustrated with it… they swore never to invest in Suzlon EVER AGAIN.

Many thought it was similar to the Enron saga & fraud. But this was not like that. It was sheer bad luck.

Such bad luck would have killed any other company… but not Suzlon…

On 17 January 2017, Suzlon Energy achieved 10,000 megawatts (10GW) installed wind energy milestone in India… hopes sparked that Suzlon Energy was down but not out.

By 2020 Suzlon had restructured its debts and turned the corner… but before it turned the corner Suzlon would be hit by the biggest storm it will ever face in its lifetime…

Tulsi Tanti the founder of Suzlon Energy passes away on 01 October 2022 from massive heart attack while arriving home from Airport … just 10 days ahead of the Rights Issue.

Suzlon Energy – The turn around:

By June 2023 Suzlon had reduced its debts to 3,200 Crs. This debt, it plans to pay off within the next 8 yrs. So if things go according to plan Suzlon could become Debt free by 2031.

In Oct 2022 Suzlon came up with Rs 1,200Cr rights issue which got oversubscribed.

This over-subscription of rights issued was the real turning point. At that time Share Price of Suzlon Energy was just Rs 6-Rs7.

Why Suzlon is a Multibagger?:

Is suzlon a multibagger? Can it grow 10x? Can it grow 100x? Can it grow 1,000x? Since the Rights Issue the share price of Suzlon Energy touched a high of Rs 11.50, then Rs 15.30 and later touched a peak of Rs 18.45.

This means people who invested in October 2022 tripled their money... in 8 months. Those who bought it at Rs 2.25 grew their money 10x. So now what remains to be seen is that if it can grown 100x and 1,000x.

To be fair the direction of Suzlon Wind energy was not very clear in 2019 so hats off to those investors who bought it at 2.25. But as of TODAY the direction of Suzlon Wind energy is very clear… its on the runway… taxiing on the runway on its own power… ready for a takeoff.

What is a multibagger? A multibagger stock is an equity stock which gives a return of more than 100% in a very short time. So by that account Suzlon Energy is already a multibagger stock.

Of course it has still not achieved phenomenal growth like MRF Ltd, Asian Paints, Pidilite Industries, Bajaj Finance, etc. If you look closely you will be able to see that just like these companies are the BEST in their field.. Suzlon too is the best in its field in India… so it is very much possible.

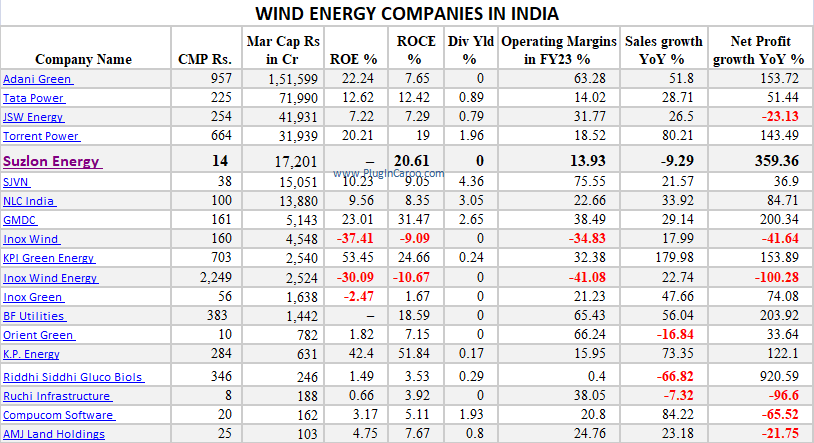

For 15 yrs from 2008 to 2023 Suzlon was busy selling off its subsidiary companies/ assets to payback its loan (taken to purchase Senvion). This was a time when Suzlon was completely tied up … YET no competitor could install more GW than Suzlon in 15 LONG years… now when Suzlon is let loose… do you think its competitors can outperform Suzlon?

Suzlon a Penny Stock: Penny Stock is a stock which is valued less than $1 (Rs 87). Thus Suzlon Energy is also a penny stock. It is very rare that you find multibagger opportunity in penny stocks.

Suzlon Energy is unfairly compared with other penny stocks like PC Jewellers, Yes Bank, Reliance Power, Vodafone Idea, Alok Industries, etc. What makes Suzlon stand out from others is that unlike these companies… Suzlon was… and still is… the best in its sector while the other companies… they are not even one of the better companies in their sector.

At Rs 18 it is not even the price of 2 cups of tea on the streets. You don’t always get the opportunity of getting the best company in the industry at Rs 18.

At Rs 50-60 its the price of 2 sandwiches.

Cavet Emptor: Be aware of Stock Market Risk:

Of course there is every chance that Suzlon Share could come down back to Rs 5 :

- the next variation of Covid could hit the market and bring all the industries to a lock-down again… or

- a war might erupt somewhere or

- riots happening somewhere or

- change in government policies, or

- change in government in power itself or

- some controversies erupts in the industry, or

- some inside corruption or fraud, rumors, etc

All such cases could all affect the company stock in the stockmarket… and the stock might collapse and go back to Rs 5. But this is a risk with all the stocks one buys at the stock market… be it Adani or TCS.

Suzlon Energy… How far will it run? | Should I sell? | Should I Buy?

So how much more will Suzlon run? Will it go back to Rs 5? … well in stock market it this is completely possible… especially if it was involved any normal business or in a sunset industry.

But is Suzlon involved in SUN-RISE industry or in Sun-Set Industry?

It is very easy to invest in companies by looking at the PAST year/quarter profit/loss of a company… even a informed class 10 or B.Com kid can do it. But to look ahead and see the potential of the company is not easy.

For Eg: Till this year (2023) Tata Motors was showing a loss… people like Rachane Ranade said “Tata Motors (then around Rs 400) will not do well because it did not have BEV”. Stock apps used to warn while buying that “this company was in loss for past 3yrs” and “Div. not issued for 10yrs”… so people did not invest in it. But if you were following Tata Motors & its updates closely it was very apparent that Tata Motors unlike others was making a lot of research & development and investing in new innovation & technology. Companies without innovation die... Tata Motors could soon become the biggest car maker in India.

As for these Financial Advisors… well a few months ago the famous YouTuber CA Rachana Ranade said Tata Motors (then around Rs 400) cannot perform well in future because it does not have BEV (battery electric vehicles). She was not applying her mind… just copy pasting from a western report she had read. We who are closely following EVs could pick it up because the term BEV is used mainly by western media. (India RIGHTLY CONSIDERS hybrid cars as polluting cars and do not cover it under FAME subsidies). Rachna is very good at financial analysis of balance sheet ( Balance Sheet is photograph of past accomplishments… even if it shows capital expenditure for future growth… figures will not tell you how the market will playout over next 3 to 5 years)… thus she has a lot of bookish knowledge. Analysis of business also takes a little more common sense… not just bookish-knowledge.

Examples of bookish knowledge vs common sense:

- Also in Indian stock market analysis it is very common to see support for QSR restaurants like KFC, McD, Pizza Hut… etc (Sapphire Foods, Devyani International Limited, etc). But if you open your eyes and see the amount of crowd inside the restaurant and at the street hawkers… you can see that the hawkers have so many customers that they do not even have time to collect money from you… they also have better variety & flavour. How can Foreign QSR compete with Indian street food? Impossible…

The food choice at every street corner from somosa, vada pav, kachori, kanda bajia, mirchi bhajia, pani pur, shev puri, dhai puri, idly, dosa, medhu vada, onion uttapa, tomato uttapa, egg omlet, burji pav, the list is endless.

whether India has a big young population, or our younger population grows or not… In developed countries illegal street hawkers do not exist … so these restaurants can make profit… if hawking gets banned in India… then the QSR business will make a lot of money… but even then their food quality … especially KFC… inside India is very inferior to that outside of India (things like this make one feel that India is more like a poor African country than a developed country).

- Another thing that makes me laugh is when they call Swiggy/Zomato/food Delivery as a business… it was IS/WAS and NEVER will be a business in India… Food was ALWAYS and is even today DELIVERED FREE from every single restaurant in India… (there is no delivery for street food… may be Swiggy & Zomato could do something there) the kirana guy brings stuff to your house for free and even gives gifts to you on Diwali. So how come you call it a business model? No wonder these Tech & VC funded Companies are NOT making any money from it.

- Why BYJUS also is not a business model:… because every housewife doubles up as a tuition teacher… ok… she might not be a very effective teacher… but she gets the work done by threats or with a stick. In every colony there will be a few such low-cost teachers. BYJUS got away with shock & awe… it scared people by telling parents that the children’s career will be ruined if they did not apply for the BYJUS course… they also did not give people time to think… plus during covid the local Aunty-teachers were not used to Zoom classes… and became handicapped… but post covid within a few years they they have upped their game and even they became tech & zoom savvy… Also India has been a land of teachers… it will continue to throw up teachers like Physicswhalla… Khan Research, BhaiKiPadhai, Enlight CBSE, Magnet Brains… how mnay will BYJUS buy?

THE UNDERLYING THING TO LEARN is that these guys are not SOLVING any problems… Its convenient to have QSR, Food delivery & Online Education… but it is not SOLVING any GREAT PROBLEM… like say what wind or solar energy OR EV is doing.

LETS EVALUATE SUZLON ENERGY Business from a different angle:

When evaluating a company we need to evaluate the kind of business it is in. Is it in a Sun-Set Industry eg Coal/Petrol/Diesel Industry?

Or is it in a Sun-Rise Industry like Renewable Energy? Suzlon is in the SunRise Industry.

Now in Renewable Energy business… how many companies are there in India?… that too for as long as Suzlon was there?.. for 28years?

Many companies started installing Wind Energy because Suzlon was silent for the past 15 yrs due to its debt obligations. Yet nobody could overtake it.

Has even 1 Indian company other than Suzlon installed 20GW in India in their life time? Manufactured? & Installed?

Suzlon’s Only threat is from China… inferior, cheap Chinese parts used by competitors… But now the pressure & sanctions on Chinese companies are mounting.

Do we even need to discuss anything further?

As for the risk… how much risky is a Rs18 stock?

Ok… you want to talk business? Let’s do it.

Servicing & Maintenance Niche & operating Cash flow: Many people do not understand that unlike solar energy, installation of EVERY wind energy turbine comes with annual maintenance contract because repairing or servicing a wind turbine is not a joke. First of all it is so high up in the air that you need specialized trained staff & equipment to service it. So companies that install wind energy usually get the contract to maintain & service and sometimes even replace these equipment if it suffers damage in bad weather or storms. Such contracts are for the lifetime of these machines. It is more like an insurance than servicing but its actually both. The more wind farm a company installs the more maintenance contract they get. Thus Suzlon has a good operating income from maintenance contracts.

Solar panels farms are comparatively small and cheap but they need constant cleaning and also a lot of land surface area.

Disadvantages of Solar: Solar doesn’t generate power at night. Meaning 50% of the time they do not generate power.

Solar also doesn’t generate enough power during rainy or cloudy days. Meaning in total… out of 24hrs x 365 days… Solar Power plant works for less than 40% of the time.

On-Grid Solar is great for individual rooftop homes but for power plants generating constant power… wind energy is also required to maintain the balance.

Suzlon Energy is ALMOST LIKE A MONOPOLY: When it comes to Wind Energy Suzlon Energy is a GIANT… it is the BEST and the MOST EXPERIENCED Wind Energy Company in India. It is almost like a monopoly… like Asian Paints is in Paints… iPhone is in smartphones, Nestle is in baby foods (Suzlon is not a total monopoly but almost like a monopoly). It towers head, neck & shoulders above the rest.

India needs to install 500Gw of clean energy at a blistering pace by 2030. Of this 40% will have to be Wind because historically it has always been approximately a 60:40 market. 60% Solar and 40% wind Energy in India.

World’s Renewable Energy Requirement: There is 500Gw needed in Europe, 500Gw in Africa, 1,500Gw in US. African market will be 100% captured by China. US might not give Indian companies business. But Enron has good chance to bid for installation in business already familiar to it in Europe… cold, snowy Europe will have to depend a lot on wind power.

Suzlon has installed 20GW worldwide in 28 yrs… meaning it installed approx 714MW every year. This means if Suzlon can install around 700MW per yr it can get back its lost position.

But due to the pressing energy need… that too CLEAN energy… for India by 2030 Suzlon COULD POSSIBLY achieve much more than that.

This report says “21.5 GW of onshore wind is forecast to be installed from 2022-2026 in India” : Read it here: https://energy.economictimes.indiatimes.com/news/renewable/india-needs-up-to-10-gw-of-annual-wind-energy-tender-capacity-to-install-70-gw-by-2030-gwec/94147782

Meaning what we saw of Wind Energy business in India till now… was only a trailer… the movie is just about to begin… . 21GW in 4 years is HUGE!!!

India’s Renewable Energy requirement:

- India is expected to set up 500GW of clean energy by 2030 of which 200W will be Wind Energy (60:40 Solar to Wind Energy ratio).

- Indian Govt is also expected to tender for about 10Gw wind energy annually (till 2028). Reverse auction (which was detrimental) in Wind Energy also has been stopped.

- By this ratio Suzlon could end up setting up more than 1GW per year.

Why will India need so much NEW electricity? Just look at Vande Bharat… its an Electric Vehicle… it is expected to replace almost EVERY SINGLE Diesel Engine in India… COMPREHEND THAT? Diesel demand could nosedive by 2030 in India but at the same time these electric trains will need a lot of Electricity.

(India’s India Trade DEFICIT could decrease considerably… India could well turn into a NET EXPORTER by 2030 and its foreign exchange could start to increase as India reduces its import of crude oil. Or rather India will be importing crude oil… refining it and exporting diesel).

Other than that Bullet trains too will soon make their presence in India again requiring huge electricity to run.

Electric boats have been deployed in Kochi and have become a big hit.

Electric Scooters, Electric 3wheelers, Electric Car & Electric buses will become common place. More Electric Buses are being sighted everyday than 6 months ago. (BTW…have you invested in JBM Auto and Olectra Greentech? Not a recommendation just inquiring).

All this will need electric energy… and ALL RENEWABLE ENERGY companies who install and generate ELECTRICITY will make money.

(We are not a SEBI Registered Investment Advisor nor is this a Recommendation to buy or sell the Stock. Stocks can move positively or negatively depending upon the market sentiment. Make sure you consult your financial advisor before investing in Stock Market. Never EVER invest in Stock Market by taking a loan because there are chances the stock price can nosedive exactly like Suzlon’s did… from Rs 459 to Rs 5.)

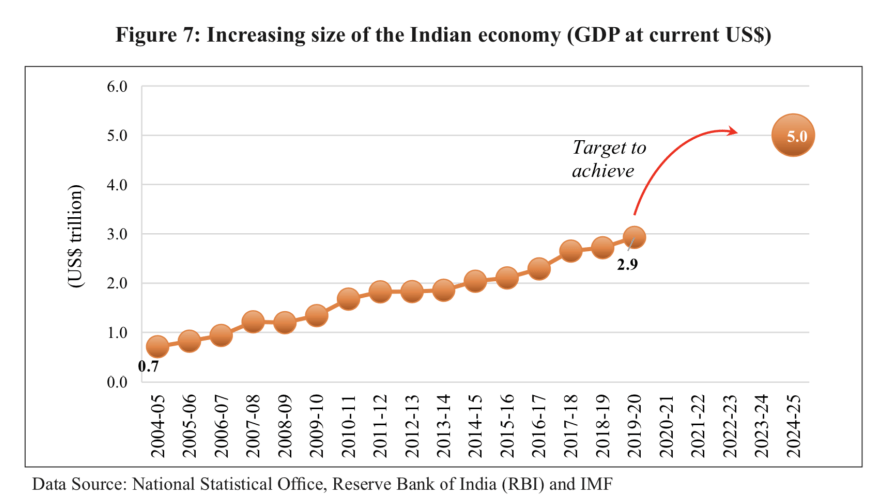

If Suzlon reached Rs 398 in 2008 when BSE index was just 18,000 and Suzlon had below 10GW installations… then CAN Suzlon reach Rs 3,980 in 2030? In 2030 the BSE index is expected to go well past 180,000 (assuming that BSE grows at 14% annually)?

Even if the previous-high share price of Rs 398 is adjusted for inflation it would be around Rs 1,100/- today.

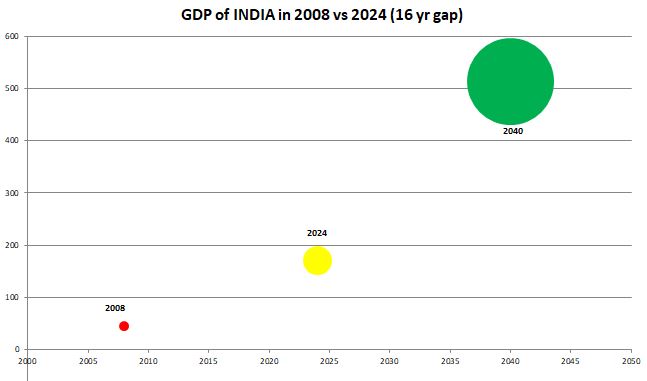

BSE Stock Index is expected to grow well past 200,000 by 2030. In 2008 the size of Indian economy was much small than it is today… and the size of Indian economy of 2023 will look much smaller than in year 2030 as the benefits of digital economy, mature GST implementation, electrification, UPI, FinTech, huge predicted growth in MSME & Renewable Energy start kicking in.

If India develops Hydrogen then we will get there even earlier… but personally I believe (after following EV & renewable energy closely) Indian business houses LACK the imagination, creativity and risk appetite… (it could be due to the lack of development or importance to creative side of children/students while in school… eg all schools in India have Arts-Crafts & Music class… but none of the students know to make a product they could use NOR learn to play even a musical keyboard in 10 yrs in music class at school.. or learn a programming language… all of which a kid can learn in 3 months. The current Arts-Crafts, Music & computer education in school is a complete waste… those periods are considered as free periods). After following the Electric Vehicle manufacturing… or the lack of it, FAME2 scam, abject shamelessness or pride-less-ness of companies using 100% Chinese parts and branding them as Indian etc, Even Tata is just swapping EV kit into its Petrol/Diesel Tiago, Tigor & Nexon… and calling them EVs… because rest of the parts are identical…complete with a fuel hatch.

If Indian Auto companies had so much trouble shifting from Emission standard Bharat 4 to Bharat 6 or manufacturing EVs after a decade of Government push, pull, incentives, govt threats, petrol price hikes…., and BioGas is hardly commercialized in India… then developing Ethanol, Hydrogen or Semiconductor chips is way beyond us Indians... in spite of the govt offering various incentives for it.. it cannot be done by the current leading business houses of today…. least of all by a Mining company. Maybe and I hope… I am wrong on this one.

If India has to make Ethanol, Hydrogen or even Semiconductor chips… then the Govt has to get into it… Private companies WILL JUST NOT do it… especially those companies from Independence Era and the Licence Raj Era… they will pretend to do it then give various excuses why it didn’t happen.

A lot of NEW companies coming up in the SunRise industry are multibaggers… just like Suzlon.

Pingback: 12 Advantages of Suzlon Energy over Solar Energy| #suzlonenergy | PlugInCaroo… Karo plugin… abhi!… save the environment!!!

Pingback: Is Suzlon Energy Stocks good or bad? | Multibagger? | PlugInCaroo… Karo plugin… abhi!… save the environment!!!

Pingback: Suzlon Wind Energy vs Inox Wind Energy… which is better? | PlugInCaroo… Karo plugin… abhi!… save the environment!!!

Pingback: Suzlon sets steady Rs 1,300 Cr revenue and profit for 5th straight quarter!!! On track multibagger | Q1 2024 | Suzlon Energy Review | PlugInCaroo… Karo plugin… abhi!… save the environment!!!

Pingback: Year 2008: A Year of Significant Events | PlugInCaroo… Karo plugin… abhi!… save the environment!!!