Jan 2026 – Unbelievable but true!

This is not a sudden phenomenon see the trend over last 5 yrs below:

Continue reading

Jan 2026 – Unbelievable but true!

This is not a sudden phenomenon see the trend over last 5 yrs below:

Continue readingइन्वर्टर क्या होते हैं?

इन्वर्टर एक इलेक्ट्रॉनिक डिवाइस है जो बैटरी जैसे सोर्स से डायरेक्ट करंट को अल्टरनेटिंग करंट में बदलता है।

आधुनिक इन्वर्टर स्मार्ट होते हैं और AC मेन पावर को DC पावर में बदलकर खत्म हो चुकी बैटरी को रिचार्ज भी कर सकते हैं।

कई कंपनियाँ सिर्फ़ इन्वर्टर देती हैं और बैटरी दूसरी कंपनी से लेनी पड़ती है। फिर आपको इन्वर्टर की पावर रेटिंग के हिसाब से बैटरी की संख्या मैच करनी होती है। इसके बाद आपको किसी इलेक्ट्रीशियन से अपने घर की पावर लाइन से सिस्टम सेट अप करवाना होता है। कभी-कभी कंपनियाँ यह सर्विस एक्स्ट्रा कीमत पर देती हैं।

ओला शक्ति एक स्मार्ट और इंटेलिजेंट यूनिट है जिसमें इन्वर्टर और बैटरी केसिंग के अंदर होती हैं। आपको बस इसे अपने घर के पावर सॉकेट में प्लग करना है।

जब पावर कट होता है तो …

Continue readingAwesome Dirt bike with height adjustable seating… and removable batteries… although marketed for the kids… would be a huge draw for Gig Workers.

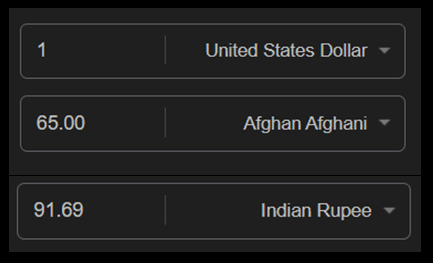

Continue readingFor years, India’s EV scooter market was stuck in a tug-of-war between premium positioning and mass affordability. Ather leaned premium-first, Ola chased flashy launches, and Hero MotoCorp cautiously dipped its toes.

Both Ather and Ola had bigger battery packs… well supported by FAME2.

Then Govt pulled the plug… no more FAME2 Subsidies.

Then Govt stabbed entire EV industry in the back… just like Kattappa did… pulled the rug from under EVs feet… Diwali 2025 will always be remembered as PUTIN’s Diwali gift… 10% discount in GST for Petrol Scooters and 0% discount for EV sector. No subsidies for EVs… nothing… NADA… kuch nahi… sampla… baad me jao EVs… kinda attitude.

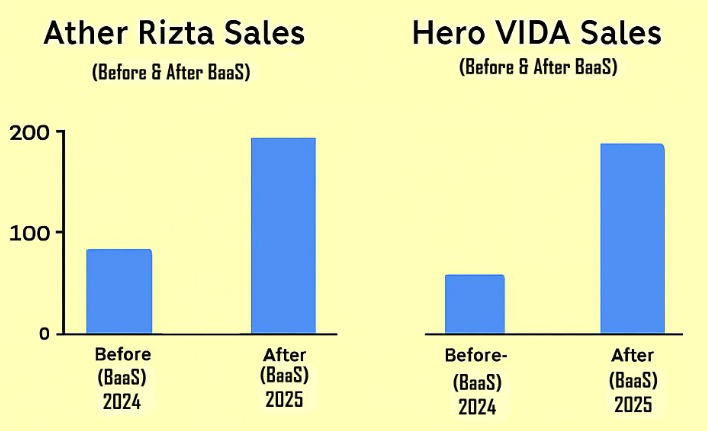

As a result eScooter sales have been flat … first time in decades. The greatest pain was suffered by the electric 2-wheeler industry… and one particularly INNOVATIVE COMPANY… OLA ELECTRIC… Ather and Hero escaped this avalanche because they had early in the year just launched BaaS. Ather was first to introduce it… Hero which is already invested heavily in Ather Energy went along with this technology.

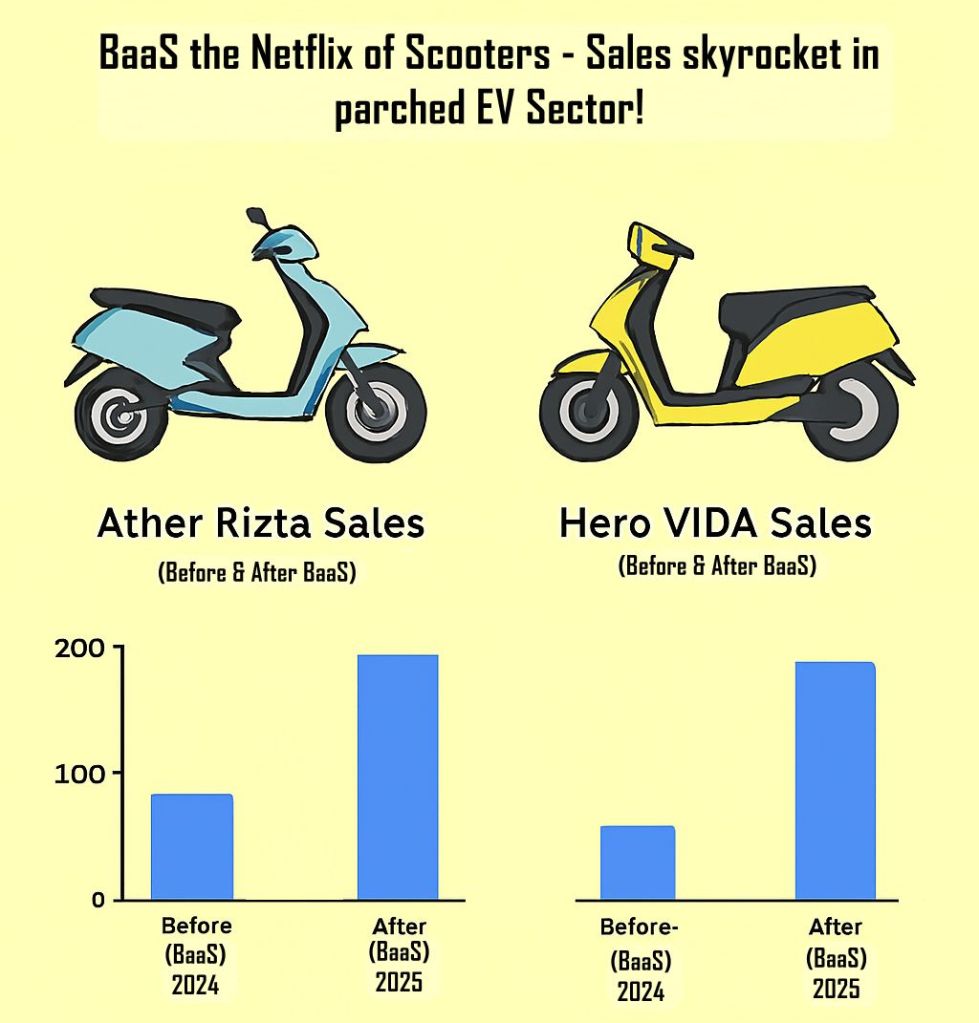

Ather introduced Battery-as-a-Service (BaaS) in India — a scheme that slashed upfront costs, shifted risk, and turned batteries into subscriptions. The eScooter’s weakness became its strength… the expensive Battery now became its strength.

A Rs 156,000 Scooter might seem very expensive for the lower middle class who primarily make up the main scooter customer. But under BaaS the price of Rs 80,000 is deducted from the scooter price and the customer can buy the scooter for just Rs 76,000 and agree to pay at Re1/per km.

Over 20yrs the scooter might do over 2,00,000 kms and earn the company Rs 2,00,000 in BaaS revenue.

The batteries will earn at least 3 times more over the lifetime of the scooter that the scooter itself. Suddenly, scooters weren’t just vehicles; they were annuities on wheels.

Ather and Hero have turned scooters into streaming services on wheels. You don’t buy the battery; you subscribe to it. Instead of binge-watching shows, you binge-ride kilometers.

The upfront cost is low, but the recurring bill keeps rolling — much like your monthly OTT subscription.

The difference? BaaS subscription comes with wheels, warranties, and a resale guarantee.

Sadhguru warns that India is “becoming a desert” because of rapid soil degradation, deforestation, and unsustainable farming practices that are leading to what he calls soil extinction.

He believes that without urgent action…

Continue readingWhen Ola Electric burst onto the scene, it wore the cape of affordability. The promise was simple: “We’ll electrify India without electrifying your wallet.” Fast forward to today, and Ola’s S1X+ 3rd Gen sits at a cool ₹1,20,000—the priciest scooter in the market. The Robin Hood of scooters has somehow become the tax collector.

Ola’s Premium Misfire

Ola Electric entered with a mass-market pitch but…

Continue readingIndia has become the world’s largest electric three-wheeler market, selling nearly 700,000 units in FY2025. The surge is fuelled by government subsidies, rising fuel costs, and the urgent need for sustainable last-mile transport. Let’s break down the top companies shaping this revolution. (हिंदी के लिए… कृपया नीचे स्क्रॉल करें)

The electric auto rickshaw market is booming, with companies like Mahindra, Bajaj, TVS, Piaggio and Atul Auto leading the charge. These brands are scaling record sales, driven by rising demand for clean, sustainable and affordable last-mile mobility.

Continue reading