End of Ice Age?… This could be the start of the end for Internal Combustion Engine (ICE) Petrol/Diesel cars & scooters/motorcycles… for… Stone age did not end due to the lack of stones.

Ola Electric, the e-scooter manufacturer submitted its initial draft papers to SEBI to initiate an initial public offering (IPO) aimed at raising ₹5,500 crore.

New equity share issuance amounting to…

₹5,500 crore and a simultaneous offer for sale (OFS) of 95,191,195 equity shares with a nominal value of ₹10 each.

(DISCLAIMER: This is not a recommendation to buy. Always consult your financial advisor before you invest in stocks/mutual funds as they fluctuate in value and thus are risky).

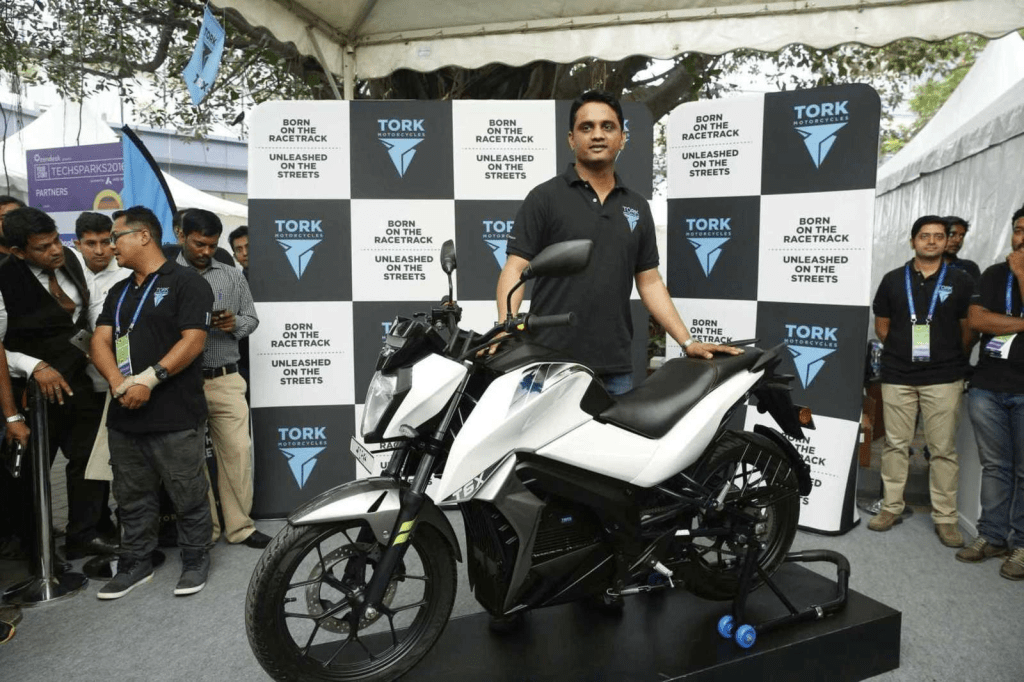

Ola will soon be launching its electric motorcycle and in connection to this Aggarwal had made ₹45 lakh investment in Pune-based electric vehicle startup, Tork Motorcycles.

TORK has been one of the most exciting electric motorcycle from India… will it relaunch at Ola Electric Motorcycle?

Risks:

- Limited operating history & accumulated losses: – This doesn’t seem to be a big issue at all because of all the vehicle manufacturing companies in the world… Ola Electric was the fastest to acquire land, build a factory building, install machines and manufacture electric scooters. Manufacturing vehicles are very capital intensive as they require various expensive machinery. If you compare the initial loss to the amount of capital required for manufacturing vehicles & Ola’s speed of launch & sale it is indeed promising.

2. Defects, quality issues & disruptions in the supply or increase in prices of components: – Ola did have defects with quite a few people experience broken front fork. To fix this it announced a massive recall for its S1 range from March 22, offering to upgrade to the new fork design… looks like a very sensible thing to do.

Ola does have much more customers than its maintenance team can handle. This is because Ola is growing at a very fast pace. Currently Ola has about 400-600 service centers (Ather has just 156 in spite of launching 5 yrs ahead of Ola). Ola’s established ICE competitors (petrol scooter makers) have around 3,500 to 4,500 service centers. Once Ola reaches about 2,000 service centers Ola’s should service problems should reduce drastically. Ola agrees that its scooters do not require regular service or maintenance while Ather INSISTS on buying a service subscription plan to get your Ather scooter serviced intermittently.

OLA vs ATHER comparison: Ather launched its 1st Electric Scooter in the 2nd month of 2016. While Ola launched its 1st electric scooter in the 8th month of 2021. While Ather is a almost a decade old Ola Electric is not even 3 yrs old yet it is topping the sales chart while Ather is not even 2nd.

3. Product recalls & legal action: Not a big deal as Ola has waded through this successfully & satisfactorily. The worst is behind Ola as it never had any manufacturing experience. Things can only get better.

4. Could face various risks in upcoming GigaFactory: Really? Wouldn’t that be true for any company? Actually once GigaFactory gets running OLA will be able to create good quality batteries at a lower cost in the GigaFactory and could get huge cost advantage over other EV manufacturers.

5. It may not be able to compete successfully in the highly competitive and fast evolving automotive market: This is entirely false because OLA has competed quite successfully in this highly competitive eScooter market. Ola is the Number One Seller of eScooters in India. Adding the benefits of GigaFactory to its successful eScooter sales could be a real game changer… Work seems to be happening at #OlaPace and expected to start in March 2024… then Ola Electric could become almost-a-Monopoly-Multibagger.

What is GigaFactory? GigaFactory will be a Lithium-Ion battery manufacturing plant Ola is building in Tamil Nadu and it will make Ola the only EV manufacturing company to manufacture Lithium-Ion batteries in India.

Many so called EV manufacturers are “trying to create batteries in India”… really? These were the same companies who were and are still testing electric cars since last 20 yrs… and releasing so called electric cars with “fuel” hatch. So you can imagine how fast and how sincere they are about manufacturing EVs and setting up battery plant in India… unlike Bhavesh Agrawal who has gone all out to establish EVs in India.

Ola Electric is also considering bidding for mining rights for lithium blocks being being auctioned by the Indian government in a move that could boost its EV battery manufacturing plans.

6. Risk of losing key managerial personnel… really? Is he talking about Infosys? Which has a very high staff turnover.

7. If the company is not able to attract and retain customers? Is this some kind of joke question right? This is the only company that has been topping the sales chart consistently… year after year.

8. Inadequate access to public charger for consumers could materially and adversely affect demand: This is more of an inconvenience than a risk. Installation of PRIVATE/PERSONAL charging stations have become somewhat unusual & unexpected problem in India.

By rule of law passed by the Indian Govt every housing society has to give NOC for installation of charger for the resident WITHIN A WEEK. This NOC is often refused by the housing societies on various grounds.

When combined with the fact that eScooters like Ola & Ather DO NOT have portable batteries to be carried home (like in Hero Vida eScooter) this is a serious inconvenience.

9. Gets revenue mainly from sale of scooters: Ola will over the years start getting revenue from public as well as personal charging stations installed by Ola… and also from manufacturing Lithium-Ion batteries..

10. Utilize certain portions of the Net Proceeds of the Offer: Every company has the prerogative to decide where certain portion of the net proceeds will go. It has mentioned very clearly that it will be allocating:

- INR 1,600 crore for research and product development

- INR 1,226 crore expanding its cell manufacturing plant capacity

- INR 800 crore for debt repayment.

Opinion: Personally after following the EV movement closely in India since more than a decade and finding a lot of fly-by-night operators, companies directly importing Chinese scooters and rebadging them without shame as Indian products.

Some of the existing big Indian petrol 2-wheeler makers refused to make eScooters & eMotorcycles in India and instead blamed the government for asking them to make EVs without installing public chargers.

In comparison to them Bhavesh Agrawal & his OLA Electric comes across as a breath of fresh air.

Ola & Ather are two genuine electric scooter manufacturers. It seems like Ather too is getting ready to IPO and a good public response to OLA IPO could encourage Ather.

This IPO seems to have excellent prospects especially if you consider Ola will be making & topping every one of the below sector:

- eScooters (10 Million)

- eMotorcycles (Yr 2025)

- Battery packs (from GigaFactory) (1GWh to 100 GWh) (March-2024)

- Electric Car (1 Million/10Lakhs) (Yr 2026)

Ola Electric Car when it debuts could indeed be a very serious threat to both Tata Motors & Maruti. Especially the speed at which Bhavesh scales up is unmatched anywhere in the world… Slow moving elephants will find it difficult to match #OlaPace… Unbelievable but true.

Currently Tata Motors manufactures about 5 Lakhs cars & Maruti manufactures about 22.50 Lakhs cars. Tata Motors after so many decades in manufacturing has not set sights on manufacturing 10 Lakh cars… Ola has 10 Lakh on plan even before it has started. There is no doubt that Ola will beat Tata to 1 million (10 Lakh) car manufacturing mark.

I expect FIIs to create a big fuss… not the first time… and carry out a media attack on Ola Electric Brand-name as they did during Patanjali/RuchiSoya IPO… and they might even abstain from buying blaming something or the other… with an intention to crash the IPO. But retailers and DII’s are very smart.

OLA Electric is here to change the world… question is… will you be a part of it?

Pingback: Tunwal eMotors IPO | PlugInCaroo… Karo plugin… abhi!… save the environment!!!

Pingback: Very positive Ola Roadster ride reviews coming through | PlugInCaroo… Karo plugin… abhi!… save the environment!!!