In the ever-evolving landscape of electric mobility, Ola Electric stands at a fascinating crossroads—a company with a bold vision, a volatile stock chart, and a growing chorus of retail investors who believe it’s a sleeping giant.

Let’s unpack why this view, while contrarian, might not be as far-fetched as it seems:

Few companies in India’s electric revolution have generated as much debate—and promise—as Ola Electric. Once riding high on its scooter success, Ola’s stock now trades like an underdog, dipping low and wearing the “penny stock” label.

A lot of confused common people think that Ola Electric is down and out… its story is over and that the company is now going downhill… but unknown to them this may be the moment the story really begins.

Let’s explore… Is Ola Electric one of the most overlooked multibagger opportunities on the Indian stock market?

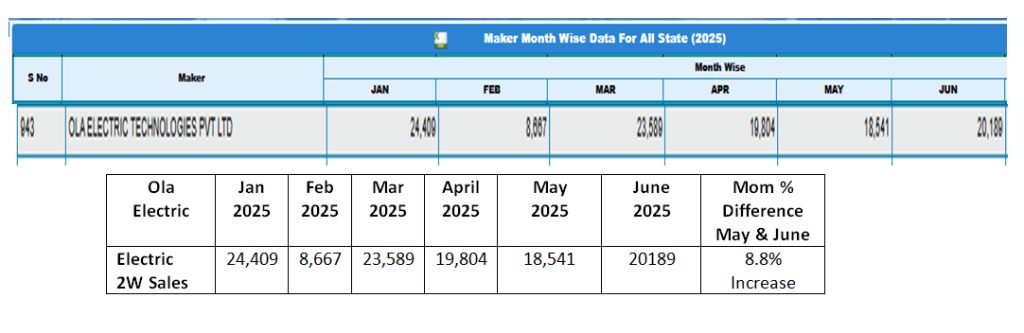

STOP PRESS… June 2025… Sales have picked up!

A Vision beyond Scooters:

Ola Electric is often reduced to its S1 series of electric scooters, but that’s just Chapter1 in its story.

In June 2025 Ola Electric launched the Gen3 series of eScooters. Its latest, most economical and best in build and finish of the lot.

Roadster series of eMotorcycles managed deliveries only in second half of June 2025. It was well received with excellent ride reviews coming through.

Vahan registration increased massively towards the end of June to above 1,500 vehicles registered per day from around 600 vehicles in May 2025.

June2025 sales turned out to be better than sales of April and May 2025.

Most of Ola rivals have just 1 electric scooter and their petrol 2 wheeler sales have already started to decline.

Ola Electric movie is just getting started… its just in its 3rd year of operation and the following are expected to be launched shortly:

– GigScooters (slow speed eScooters) With Bharat Cell battery – economical scooters with portable battery for food delivery & grocery companies.

– Z-Series (slow speed eScooters) With Bharat Cell battery – economical scooters with portable battery.

(Ola Electric will be the only branded company selling slow speed scooters with portable battery).

– 500km range eMotorcycle.

– Electric auto-rickshaws, for the urban transport segment.

– Home energy solutions, including charging and storage systems.

– and possibly even Electric cars, with teasers already fuelling speculation

The best thing is that this massive portfolio expansion is still ahead of us—and the current stock price doesn’t even reflect it.

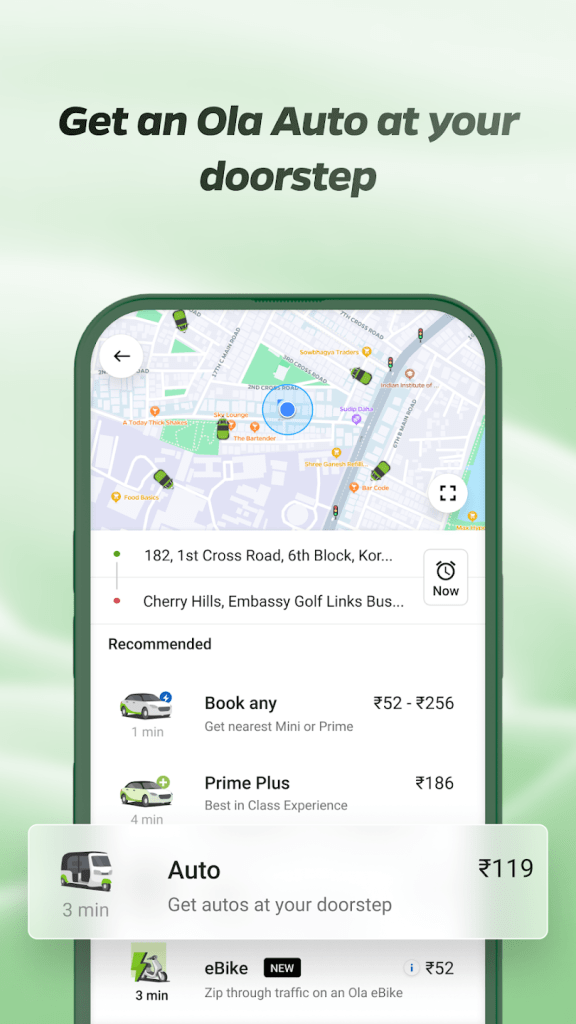

Ola Ride Hailing App for Auto-Rickshaw business:

Although Ola Cabs is a separate company of Bhavish Aggarwal … it will leverage the abilities of its Ride Hailing App.

Ola Cabs has the data of all of its drivers and how much they earn. Ola recently invited more auto-drivers to join the platform by abandoning the commission system in favour of the Daily Fee of Rs 67/per day for using the App by the Driver.

Ola can easily convert almost 100% of its drivers to switch to an electric auto rickshaw by giving them easy EMI options or discounts or even by educating them of how much they will save by switching to electric auto rickshaw.

This Ride Hailing App of Ola Cabs and Ricks… is a BIG ADVANTAGE for Ola Electric… something none of its rivals have (even Mahindra)... Bhavish could use it to his advantage… to get ahead of his rivals.

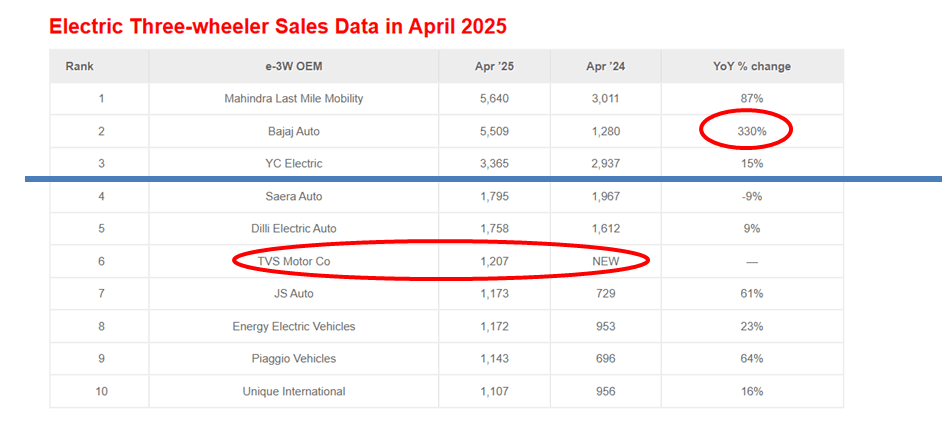

BIG OPPORTUINITY IN electric 3W:

Electric Auto Rickshaw sector has small time players… Seven Of the top 10 makers of eAuto Rickshaws are small time companies. These companies can be easily overtaken by Ola Electric.

In electric 3Wheelers Bajaj Auto has upped its game by 330% and has almost caught up with Mahindra. It is possible that Bajaj Auto could overtake Mahindra Last Mile Mobility by the end of this year.

TVS is the new entrant and has already landed on the 6th spot.

But what is evident is that only the top 3-4 (including TVS this year) are doing some serious EV manufacturing. So it will be very easy for Ola to land up in 3rd or 4th spot in the 1st year itself in 2025.

Ola Electric Auto Rickshaw was expected to be launched by June 2025… Or fingers crossed Ola Auto Rickshaw will be launched on 15 August 2025… If it doesn’t then it could be delayed by another 3-6 months. DELAYS IN MANUFACTURING IS VERY COMMON ACROSS THE WORLD… even iPhone release gets delayed… nothing to be shocked about.

Ola’s Li-Ion cell called Bharat Cells is undergoing extensive trials and is expected to be integrated into their vehicles, including the Ola Gig and S1 Z.

Once Ola starts manufacturing its e3W it can really leverage the scale of battery manufacturing delivering a severe blow to its competition who have no plans of battery manufacturing.

The Power of Vertical Integration

At the heart of Ola’s long-term play is its GigaFactory in Tamil Nadu.

– The plant will scale up from 1.5 GWh to 20 GWh, rivaling global players

– Ola will manufacture its own lithium-ion cells, slashing battery costs

– Vertical integration gives it pricing power and supply chain control, which few Indian EV startups can claim

This factory isn’t just an upgrade—it’s the launchpad for Ola’s entire future product lineup.

From Despair Comes Opportunity

Yes, Ola Electric posted a substantial Q4 FY25 loss and saw revenues decline. This could be the classic “pain-before-profit” phase:

– Stock has tumbled 70%+ from its highs—valuations are now compressed

– Big-name investors like Tiger Global haven’t exited

– Ola has acknowledged past mistakes and is pivoting hard toward profitability

This scenario echoes the early days of many eventual multibaggers—where panic creates a buying window… same was the case with Tesla and Suzlon Energy.

Ola is “not just a company—it’s a national mission.”

– India’s EV adoption curve is about to bend sharply upward

– Ola is best positioned with product, infrastructure, and brand

– Retail investors can get in early, with a low entry price and high upside potential

Ola is building India’s Tesla—not in brand, but in its ambition to control product, battery tech, and energy services.

ADVANTAGE OF PENNYSTOCK:

Buying penny stocks—those low-priced shares typically trading under ₹50 in India or $5 in the U.S.—can feel like hunting for hidden treasure. While they come with high risk, they also offer some unique advantages that attract bold investors. Here’s a breakdown of the key benefits:

- Low Entry Cost

– You can start investing with a small amount of capital.

– Ideal for beginners or those testing the waters of equity investing.

- High Return Potential

– If the company grows or gets re-rated, even a ₹5 stock can become ₹50 or more.

– Some penny stocks have historically turned into multibagger eg: Titan, Trent, Suzlon Energy, etc

- Retail Investor Friendly

– Affordable share prices make them accessible to a wider audience.

– You can accumulate a large number of shares for a relatively small investment.

- Early Exposure to Emerging Companies

– Many penny stocks belong to startups or niche players in sunrise sectors.

– Getting in early means you ride the wave if the company scales up.

- Psychological Edge

– Watching a low-cost stock double or triple can be more motivating than a 5% gain on a blue-chip.

– It encourages learning, research, and active engagement with the market.

- Above all… it allows you to buy huge quantity.

A Penny stock due to its low price allows you to buy in thousands … instead of hundreds.

For eg You can buy 10,000 shares of a company priced Rs 10 for Rs 1 lakh… but with Rs 1 Lakhs you will get only 100 shares of a company whose share price is Rs 1000.

1:1 Bonus on a 10,000 shares give you a total 20,000 (10k+10k) shares after bonus.

Then If a company pays Rs 2 as Dividend every year you will get Rs 40,000 every yr.

You could put Rs 40K in new stocks every yr. Bonus and stock splits are how wealth multiplies. (Some people NEVER invests in companies which don’t give Bonus or Stock Splits).

But a person having just 100 shares will get 100 more after bonus. Then next yr even if he gets Rs 2 dividend he will get only Rs 400 (Rs 2 x 200 shares). This is almost of no use.

That said, penny stocks are not for the faint-hearted—they’re volatile, often illiquid, and can be prone to manipulation.

But for those who do their homework and manage risk wisely, they can be a thrilling part of an investment journey.

ADVANTAGES OF OLA ELECTRIC:

- OLA Electric is the market leader based on the number of eScooters sold till date.

- Unlike other CEO’s who were asking for directions from the Govt and arguing with the Govt… Ola CEO had clear vision about the growth of EV sector and the scale required to reach early break even.

- Unlike its rivals Ola Electric does not have to deal with the burden of falling sales of Petrol Scooters and eventually its Dealerships suffering loss in Petrol Scooter ecosystem of Service & Maintenance which is a big loss in itself… unlike the Electric Vehicles which do not have major or regular service requirements. This is not just about MANUFACTURING & Selling eScooters— EVs not only destroy Petrol Vehicle sales… EV also destroy the existing Petrol Scooter ecosystem on which thousands of dealerships survive. This will be a major pain point for existing petrol 2 wheeler companies.

- None of its rivals have any plans of manufacturing Lithium-Ion or Lithium-Phosphate batteries till date… while Ola Electric has already installed huge plant to manufacture batteries. These batteries called Bharat Cells will debut with GigScooters & Z-Series eScooters.

- Rivals have just one vehicle… while Ola Electric has 10 different 2 wheelers to be launched, Electric Rickshaws and possibly even electric Cars.

- Ola Electric already has a rickshaw driving community on its Ola Cabs platform which can be leveraged to sell Electric Rickshaws.

- None of its rivals have a Ride Hailing App.

- Bhavish Aggarwal has hinted at becoming profitable in a couple of Quarters.

- Bhavish Aggarwal had mentioned a target of 25,000 vehicle sales per month to turn profitable.

So the question remains… Can Ola Electric deliver? Can it be called a Multibagger?

This is neither a recommendation to buy or sell the stock. This is just a case study for educational purposes.