India’s ambition to become a global leader in electric mobility has been loudly proclaimed through policy papers, speeches, and incentive schemes.

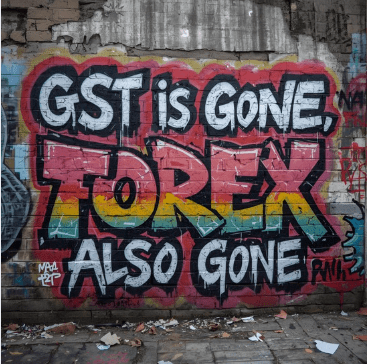

Yet, recent decisions—like reducing GST by 10% on petrol 2-wheelers while maintaining a 5% GST on electric scooters—reveal a troubling flip-flop in the government’s commitment to clean transportation.

This contradiction not only…

undermines the electric vehicle (EV) ecosystem but also risks long-term economic and environmental costs.

The Two-Wheeler Reality in India

Two-wheelers are the lifeblood of Indian mobility. With over 200 million units on the road, they dominate daily commutes, especially in Tier 2 and Tier 3 cities. Their affordability and agility make them indispensable—but they also account for a significant chunk of India’s petrol consumption, which in turn drives up foreign exchange outflows due to crude oil imports.

In this context, electric two-wheelers (E2Ws) offer a transformative solution. They promise lower operating costs, zero tailpipe emissions, and reduced dependence on imported fuel. Yet, instead of turbocharging this transition, the government’s recent move to cut GST on petrol scooters sends a confusing signal.

The Economic Double Whammy

Reducing GST on petrol two-wheelers may offer short-term consumer relief, but it’s a long-term fiscal and strategic misstep:

- Loss of GST Revenue: Petrol scooters are still the majority. A GST cut here means a substantial drop in tax collection from a high-volume segment.

- Loss of FOREX: Encouraging petrol vehicle sales directly increases fuel demand, thus losing Foreign Exchange (ForEx) worsening India’s trade deficit.

Eg: A company like Royal Enfield… which makes heavy bikes in 350cc capacity bikes which consumes a lot of petrol… benefitted the most. Meaning more people were encouraged by the GST cut to buy a Royal Enfield bike.

- Missed EV Momentum: EV manufacturers, already grappling with supply chain challenges, now face a skewed playing field where the cleaner technology that improves India’s Trade Deficit is also taxed.

Policy Incoherence

This isn’t the first time India’s EV policy has shown signs of inconsistency. FAME1 was replaced with FAME2 which almost eliminated all of the pioneers of Electric 2 Wheeler innovation. Companies which had taken great risks in creating demand in Indian market were pushed out.

Although PLI scheme offers production incentives, consumer-side support remains patchy. The lack of zero GST for electric two-wheelers, despite their strategic importance, reflects a disconnect between vision and execution.

Why in India electric 2Wheelers don’t have Zero GST?… At least for the next 10 years? Why? Is there any answer to that?

If the government truly wants to electrify India’s roads, it must align its fiscal policies with its climate and energy goals. That means:

1) Zero GST on electric two-wheelers,

2) Robust charging infrastructure, and

3) Sustained public awareness campaigns.

First ZeroGST on EVs… then the rest.

The Road Ahead

India stands at a crossroads. It can either continue subsidizing fossil-fueled mobility and pay the price in foreign exchange and pollution—or it can embrace electric mobility with clarity and conviction.

The choice should be obvious. Flip-flops may work on beaches, but not on policy roads paved with ambition.