(edited on 10 Oct2025 … 2nd last para)

September 2025 was a rough ride for Ola Electric. Once a dominant force in India’s electric two-wheeler market, the company saw its sales drop to 13,371 units, slipping to fourth place behind TVS, Bajaj, and Ather. But this wasn’t a story of fading demand—it was a perfect storm of policy shifts, competitive pricing, and delayed product rollout.

Let’s break down what happened:

Disclaimer: The information provided is for educational and informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, including the potential loss of principal. Always consult with a qualified financial advisor before making investment decisions.

Reasons for Ola Electric Sept 2025 sales drop:

1. GST cut made Premium Petrol Scooters attractive.

On September 22, 2025, the GST Council slashed the tax rate on petrol two-wheelers under 350cc from 28% to 18%.

This 10% reduction was a significant price reduction which made Petrol Scooters more attractive, triggering a sudden surge in demand for petrol-powered models.

Royal Enfield benefited the most from this GST cut

The Hunter, Classic, Bullet, Goan Classic, and the Meteor models reduced their prices by Rs 20,000.

2. Bajaj Auto’s Pulsar Discounts

Bajaj didn’t just rely on the GST cut—it launched the “Hattrick Offer”, slashing prices on Pulsar models by up to ₹23,000. This included waived processing fees, insurance discounts, and festive financing options. The result? A massive spike in bookings and a strong September showing.

3. Ather’s BaaS Strategy: Disruptive Pricing

Ather Energy introduced Battery-as-a-Service (BaaS) for its new Rizta scooter, reducing the upfront price from ₹1,33,000 to ₹76,000. This move made premium EVs more accessible and helped Ather climb to third place with 18,109 units sold.

4. Ola’s Roadster Arrived Late

Ola’s much-anticipated Roadster was expected to boost September sales—but it arrived only by Navratri, missing the early-month booking window. This delay meant Ola couldn’t capitalize on the initial festive rush, while competitors flooded the market with discounted petrol and EV models (Ather).

Ola ek Lambi Race Ka Ghoda hai!

Despite the September slump, Ola Electric has several strategic levers that could drive a strong comeback:

1. Project Lakshya & Vistaar: Expanding the Reach

- Project Lakshya: Expanding dealer networks in Tier 2 and Tier 3 cities

- Project Vistaar: Enhancing service infrastructure and customer experience

These initiatives aim to make Ola Electric more accessible and reliable—key factors in converting petrol loyalists to EV adopters.

2. Shift to Ferrite Motors: Cutting Costs, Boosting Margins

Ola’s transition to Ferrite-based motors is a strategic masterstroke:

- Lower production costs than Neodymium motors

- More sustainable and scalable

- Improved gross margins, allowing competitive pricing without sacrificing profitability

This tech shift strengthens Ola’s financial position and gives it room to offer festive discounts of its own.

This also proves that Bhavish Aggrawal is not just talk… but he walks the talk. The shift to Ferrite motors would increase peoples faith in Bhavish Aggrawal.

3. Gross Margin Improvements = Long-Term Resilience

While ICE brands are chasing volume through discounts, Ola is building a sustainable business model:

- Streamlined manufacturing

- Reduced battery costs

- Better unit economics

This positions Ola to weather short-term policy shocks and emerge stronger in the long run.

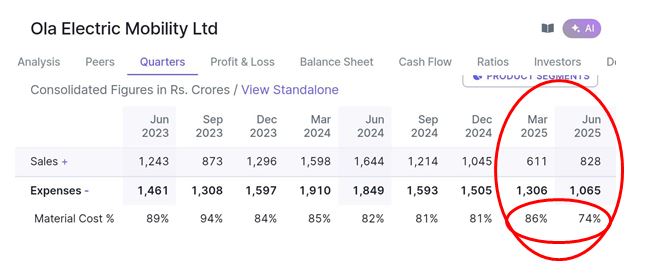

Material costs make up more than 80% of OLA’s EXPENSES… if this reduces it’s chances of Profitability INCREASES. Material Expenses seems to have started reducing since June 2025.. came down 12%… to 74% from 86% in March. It will keep increasing with time… Since Ola makes everything in-house it has this advantage… It’s RIVALS who just assemble 2-wheelers will not have this advantage.

Ather Energy has been in LOSS since last 12 yrs… on the other hand Bhavish Aggarwal expects Ola to turn profitable in Q2… Report expected!

Final Thoughts

Ola Electric’s September 2025 dip was a temporary setback caused by external factors—GST cuts, aggressive ICE discounts, Ather’s disruptive pricing, and Ola’s delayed product launch. But with strategic expansion, tech innovation, and improved margins, Ola could push for a strong rebound in Q4.

In the race between short-term price wars and long-term disruption, Ola Electric is betting on the future—and it might just win.