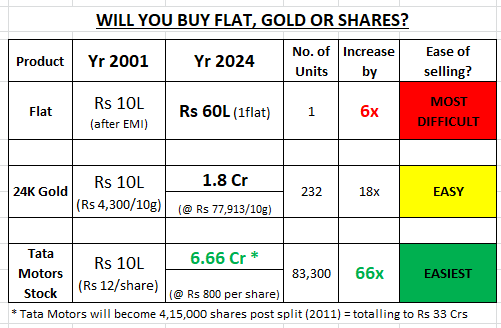

When it comes to investing, the age-old question remains: where should one park their hard-earned money—real estate, gold, or equities? Each asset class has its own allure, risks, and rewards.

But what if we could travel back to the year 2001 and make a choice with ₹10 lakhs?

Let’s explore how that decision would have played out by 2024.

🏠 Option 1: Buying a Flat

In 2001, a modest flat…

could be purchased for ₹5 lakhs. However, factoring in interest and repayment through an EMI over 20 years, the actual cost balloons to ₹10 lakhs. Fast forward to 2025, and that same flat is now worth ₹60 lakhs—a sixfold increase.

- Initial Cost (2001): ₹10 lakhs (including EMI)

- Value in 2024: ₹60 lakhs

- Return: 6x

Real estate offers tangible security and utility, but it comes with maintenance costs, taxes, and liquidity challenges.

Option 2: Investing in Gold

Gold has long been considered a safe haven. In 2001, the price of gold was ₹4,300 per 10 grams. With ₹10 lakhs, one could have bought approximately 232 units (10 grams each), totaling 2,320 grams.

By 2024, gold prices have surged, and the same quantity is now worth ₹1.80 crores.

- Initial Cost (2001): ₹10 lakhs

- Value in 2025: ₹1.80 crores

- Return: 18x

Gold worth Rs 10 Lakhs is NOT that easy to store at home or dangerous to be transported because thieves love it. It is globally accepted, but it doesn’t generate income and can be volatile during economic booms. Gold ETF or Gold Bonds are good options.

Option 3: Buying Shares of Tata Motors

Equities are often seen as risky, but they can be immensely rewarding. In 2001, Tata Motors shares were priced low enough that ₹10 lakhs could buy 83,300 shares. By 2024, those shares have skyrocketed in value, now worth ₹6.66 crores.

- Initial Cost (2001): ₹10 lakhs

- Value in 2025: ₹6.66 crores

- Return: 66.6x

Stocks offer high liquidity and potential dividends, but they require knowledge, patience, and resilience against market fluctuations.

Tata Motors had given Stock Splits in Sept 2011, thus those who had 1 share received extra 5 shares. So 83,300 shares would become 4,15,000 shares, which touched Rs 800 in 2024 totaling more than Rs 33 Crores. The 4L shares also received dividend of Rs 6/- per share in 2024 totaling Rs 24L as dividends in Year 2024. But we did not want to add more complication to the calculation for the common man.

📌 Conclusion: The Power of Choice

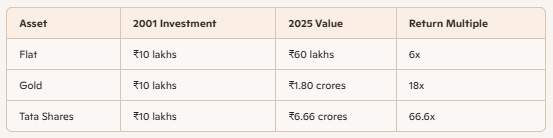

If you had invested ₹10 lakhs in 2001:

Clearly, equities delivered the highest return. But the best investment isn’t just about numbers. It depends on your risk appetite, financial goals, and time horizon.

So, will you buy a flat, gold, or shares? The answer lies not just in the past performance, but in your future vision.