Disclaimer: Stock market investments involve risk, including potential loss of principal. The information provided is for educational and informational purposes only and should not be considered financial advice. Always conduct your own research or consult a licensed financial advisor before making investment decisions. Past performance is not indicative of future results.

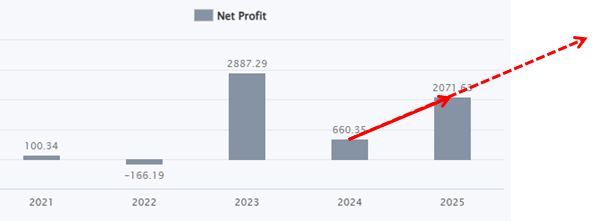

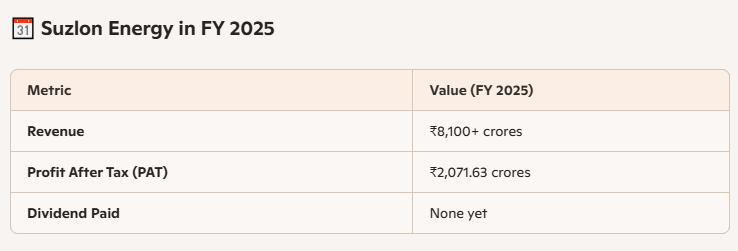

Suzlon Energy Ltd. delivered a stellar performance in FY 2025, marking its best year in over a decade.

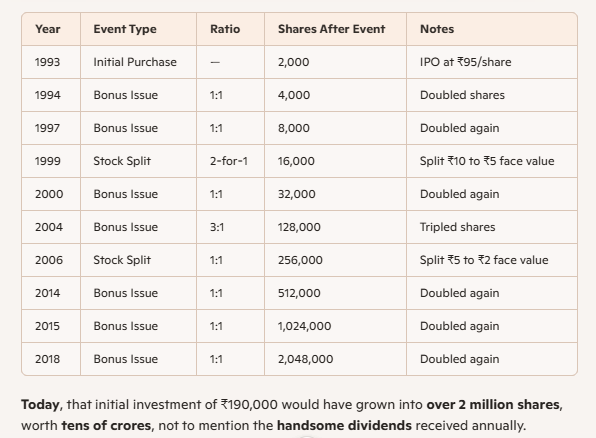

Holding a share long term (1-10 yr) increases the chances of getting bonus and splits which dramatically compounds wealth.

See below example of Bonus/Split in Infosys history:

Holding more than 2,000 shares ensures that the dividends are meaningful. Dividends are meaningless ONLY to those who hold less than 1,000 shares.

See below example of Dividend payment Infosys history:

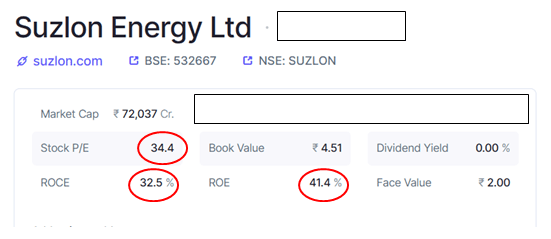

Is Suzlon near its Peak?

In 2007 when Suzlon was at its peak it had Revenue of 5,255 Cr and Profit of Rs 1,017 Cr and it had paid a dividend of Rs 5/-.

₹1,017 cr profit in 2007 is roughly equivalent to ₹2,899 crores in 2025, adjusted for inflation.

This means Suzlon is back and near its peak ONCE AGAIN!!!

So can we expect dividends soon?