Ola Electric, once synonymous with India’s booming electric scooter market, is undergoing a strategic transformation that could redefine its role in the country’s clean mobility and energy landscape.

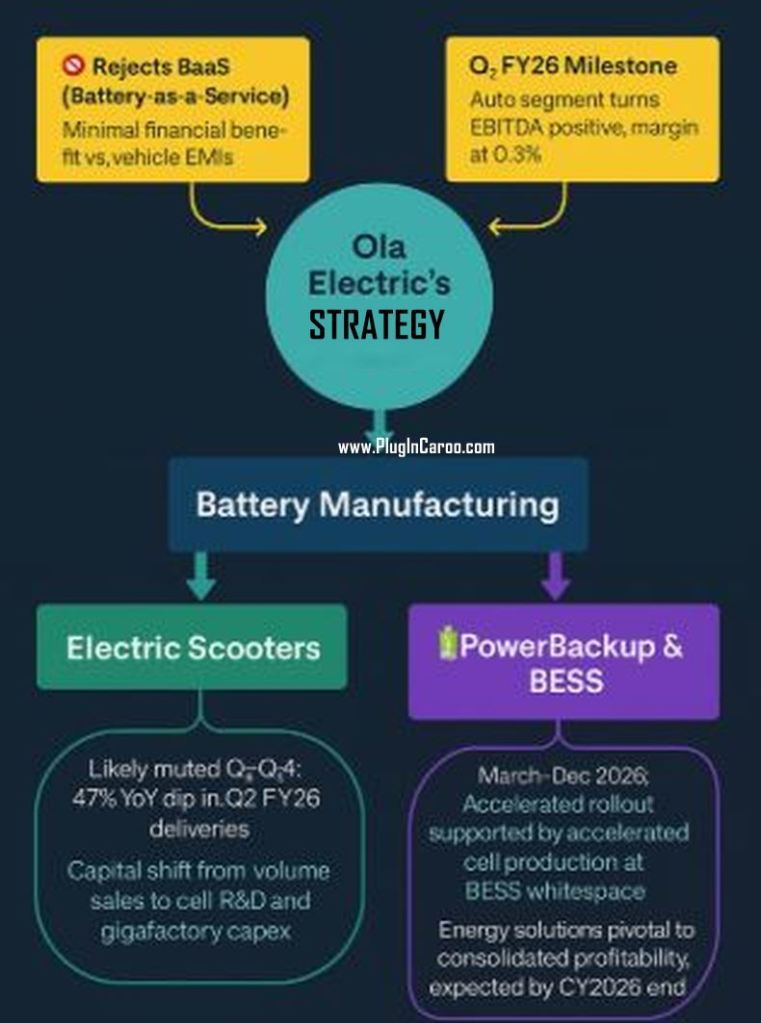

While its two-wheeler business has reached a critical milestone by turning EBITDA positive in Q2 FY26, the company’s future ambitions stretch far beyond scooters — into battery manufacturing, energy storage, and grid-level infrastructure.

Ola Electric has done very well…

to turn EBIDTA positive in its Auto business (unlike its rivals, Ola has multiple businesses like Battery, PowerBackUp, BESS, 3W and 4W).

Why Ola is in loss?

Among Ola Electric’s various ventures, battery cell manufacturing and gigafactory development have emerged as the most capital-intensive.

It is this battery cell manufacturing and Gigafactory development which is take up most of Ola Electric’s resources.

Q2 FY 2026 Negatives:

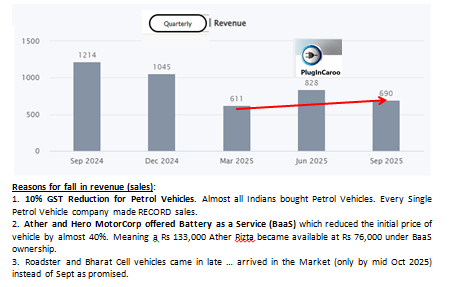

- Scooter Sales Decline: 52,666 units delivered — down 47% YoY and 23% QoQ.

- Revenue Drop: Fell 43% YoY to ₹690 crore.

- Consolidated Net Loss: Still at ₹418 crore, though narrowed from ₹495 crore.

- Muted Outlook for Q3–Q4: Could see lower sales in scooter sales due to tapering festival demand. But he talked about a “sales backlog” waiting to be cleared.

- No BaaS Expansion: Company ruled out Battery-as-a-Service, limiting recurring revenue options.

When will Ola become Profitable?

With its auto business now EBITDA positive and its energy ventures gaining traction, Ola Electric is on a path toward consolidated profitability by late FY26 or early FY27.

Financial Inflection Point: EBITDA Positive in Q2 FY26

In Q2 FY26, Ola Electric’s auto segment posted its first-ever EBITDA profit of ₹2 crore, with a margin of 0.3%. This marked a dramatic turnaround from a ₹162 crore loss in the same quarter the previous year.

The company achieved this despite a 47% year-over-year drop in scooter deliveries, signaling a shift from volume-driven growth to margin-focused sustainability.

Operating expenses fell significantly, and gross margins expanded to 30.7%, outperforming many ICE two-wheeler peers.

However, Q3 and Q4 FY26 may witness lower scooter sales due to post-festive demand softening and selling without discounts. This acknowledgment underscores the company’s pivot toward more capital-efficient and scalable ventures.

Battery-as-a-Service: A Strategic Rejection

Contrary to industry speculation, Bhavish Aggarwal clarified during the Q2 FY26 conference call that Ola Electric is not pursuing Battery-as-a-Service (BaaS) ownership.

He mentioned that financial companies are already offering EMI on scooters which have almost similar price and the difference is very less.

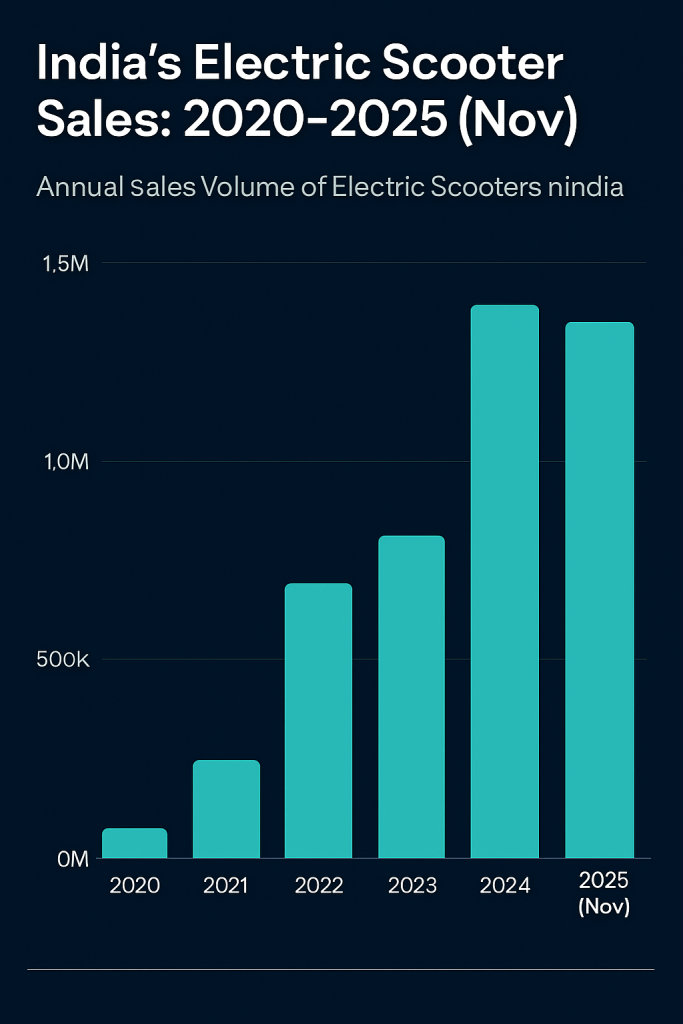

He mentioned that the electric scooter sales have plateaued as the early adopters have already bought electric scooters and expects a next wave of buyers to drive growth.

PowerBackup and BESS: The New Growth Engines

As scooter sales plateau, Ola Electric is doubling down on its PowerBackup and Battery Energy Storage System (BESS) businesses. These segments are expected to gain momentum from March to December 2026, driven by rising demand for residential and commercial energy storage in India’s Tier 2 and Tier 3 cities.

Ola’s BESS rollout aims to support grid-level storage, renewable energy integration, and industrial backup — positioning the company as a key player in India’s clean energy transition.

This energy vertical could become profitable by the end of CY2026, supported by government incentives and operational scale.

CONCLUSION:

Ola Electric, once synonymous with India’s booming electric scooter market, is undergoing a strategic transformation that could redefine its role in the country’s clean mobility and energy landscape.

While its two-wheeler business has reached a critical milestone by turning EBITDA positive in Q2 FY26, the company’s future ambitions stretch far beyond scooters — into battery manufacturing, energy storage, and grid-level infrastructure.

- Scooter sales may be cyclical, but they remain a core business.

- PowerBackup and BESS are not replacements but complementary growth engines that help absorb battery production and stabilize revenue.

- Ola’s rejection of BaaS reinforces this — it’s not chasing every trend, but focusing on ownership-based, high-margin, scalable applications of its battery tech.

Ola isn’t pivoting from scooters — it’s scaling up through batteries… with Scooters, PowerBackup, and BESS as synergistic outputs of a unified manufacturing and energy platform.