India’s electric two-wheeler revolution, once marked by explosive growth, appears to be entering a phase of consolidation.

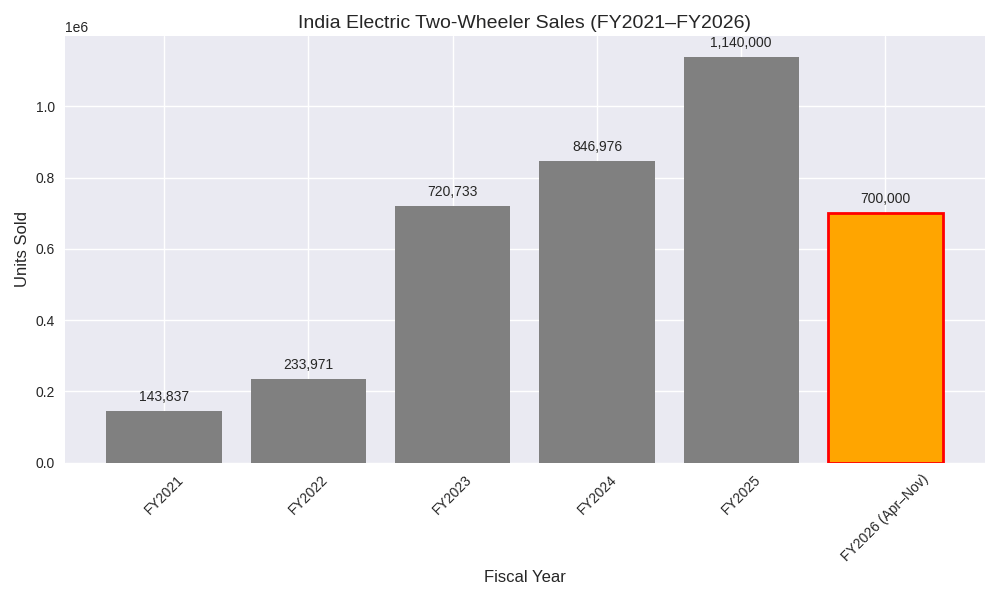

After a meteoric rise from 144,000 units in FY2021 to 1.14 million in FY2025, the April–November 2025 figures for FY2026 suggest a slowdown.

With only 700,000 units sold in the first eight months, the market is unlikely to surpass FY2025’s total unless a dramatic surge occurs in the final quarter.

This deceleration raises a critical question: Has the E2W market plateaued?

Lets analyze: …

Growth Trajectory: From Boom to Balance

- FY2021–FY2023: The market grew over 400% in two years, driven by FAME-II subsidies, rising fuel prices, and a wave of new entrants.

- FY2024–FY2025: Growth moderated to 17.5% and 34.6%, respectively—still healthy, but clearly tapering.

- FY2026 (Apr–Nov): At ~700,000 units, the market is tracking toward ~1.05–1.1 million units for the full year—flat or slightly negative YoY.

Why the Plateau?

- Subsidy Rationalization: The FAME-II subsidy revision in mid-2023 reduced upfront incentives, making EVs less price-competitive.

- Saturation in Urban Markets: Early adopters in metros have largely converted. Tier-2 and Tier-3 penetration remains sluggish due to infrastructure gaps.

- Premium Prices: Most of the Vehicles are priced above Rs 100,000/- as people have realised a 100km bike costing below Rs 100,000 can give a real world range of just 60-70kms. Earlier wiith subsidy they were able to buy a 150km range scooter. Various factors and inflation has pushed the electric scooter beyond the reach of the last man in the economic queue. This proved to be true because those companies (Ather & Hero MotorCorp) who gave the scooter at 40% reduced cost in BaaS model hit record sales in Oct 2025.

- Policy Whiplash: The most jarring blow came during Navratri 2025, when the government announced a 10% GST incentive for PETROL 2-wheelers—while offering no such relief for electric scooters. The govt was willing to lose 10% GST in the HUGE Petrol scooter market… but was not willing to lose 5% GST on the tiny eScooter market. This move, timed just before the peak festive season, was widely seen as a step-motherly treatment of the EV industry... Why govt couldn’t give 5% discount in eScooter while it gave 10% discount for petrol scooter… will always remain a mystery… Maybe GOVT wants India to consume more and more petrol???

Diwali 2025: A Petrol-Powered Frenzy

The impact of this policy shift was immediate and dramatic. Diwali 2025 witnessed record-breaking sales of petrol scooters across all major OEMs. From Hero to Honda, TVS to Suzuki, showroom floors were swept clean.

It seemed as if every Indian household opted for a petrol two-wheeler, lured by the sudden price advantage and familiar reliability.

In contrast, electric scooter sales stagnated—despite improved models and rising environmental awareness. The lack of incentives, coupled with festive price sensitivity, tilted the scales decisively toward ICE vehicles.

What This Means

FY2026 doesn’t signal a collapse—it signals maturity under stress. Electric 2-Wheeler Manufacturers need to have another product in the market to overcome such policy setbacks. (eg: Ola Shakti-UPS and BESS are good initiative during such periods of stagnation).

The E2W market is transitioning from a subsidy-fueled sprint to a marathon of sustainable growth.

But policy inconsistency and misplaced incentives risk derailing this momentum.

If India is serious about electrification, it must align fiscal policy with environmental goals—not undercut them during peak buying seasons.

In essence, India’s E2W market hasn’t hit a wall—it’s been sideswiped.

FY2026 may be remembered not just as the year growth plateaued, but as the year policy pulled the handbrake.