When Ola Electric burst onto the scene, it wore the cape of affordability. The promise was simple: “We’ll electrify India without electrifying your wallet.” Fast forward to today, and Ola’s S1X+ 3rd Gen sits at a cool ₹1,20,000—the priciest scooter in the market. The Robin Hood of scooters has somehow become the tax collector.

Ola’s Premium Misfire

Ola Electric entered with a mass-market pitch but…

quickly pivoted to premium pricing:

- The S1X+ 3rd Gen costs ₹1,20,000, making it the most expensive mainstream EV scooter.

- Despite strong initial sales, Ola’s pricing strategy now risks alienating its core audience—those who view scooters as a necessity, not a luxury.

This shift contradicts the very ethos of Indian two-wheeler ownership: low upfront cost, low maintenance, and high utility. Ola’s feature-rich dashboards and app integrations may appeal to tech-savvy urbanites, but they don’t justify the price hike for the average buyer.

The Two-Wheeler Truth: It’s a Utility, Not a Luxury

In India, two-wheelers are not lifestyle accessories—they’re lifelines. They ferry workers, students, delivery riders, and families through congested cities and rural roads. The dominant buyers are price-sensitive, often from lower-middle-income groups.

- Hero MotoCorp and Honda dominate with entry-level models priced under ₹80,000, commanding over 55% of the market share.

- TVS and Bajaj, despite offering electric variants, keep dashboards and features minimal to maintain affordability.

- Electric two-wheeler sales crossed 1 million units in 2024, but the bulk of these were in the sub-₹1 lakh segment

Ather’s Price Drop with BaaS

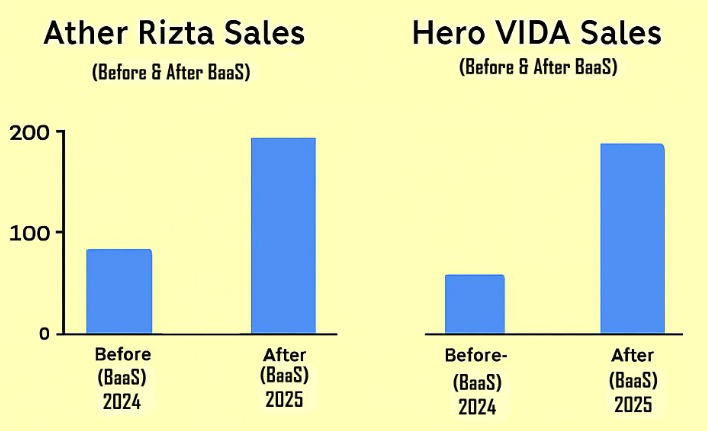

Meanwhile, Ather Energy entered as the “Apple of scooters”—premium dashboards, sleek design, and a price tag that made wallets tremble. Yet in 2025, Ather’s Rizta S is available at ₹76,000 (with Battery-as-a-Service), offering all the bells and whistles once reserved for the elite. In short, Ather pulled a reverse-Ola: from premium outsider to people’s champion.

The Wise Elders—TVS & Bajaj

Then there are the veterans: TVS Motors and Bajaj Auto. Their scooters (iQube and Chetak) are priced in the ₹1,02,000–₹1,08,000 range, but here’s the kicker—their dashboards are deliberately simple. Why? Because they know scooters are still seen as the “poor man’s vehicle.” Strip away the frills, keep costs manageable, and sell to the masses. It’s not glamorous, but it’s effective.

The Royal Enfield Exception

Royal Enfield is the lone wolf in India’s premium two-wheeler space:

- Its bikes are priced well above ₹1.5 lakh.

- Yet it thrives because it sells aspiration, heritage, and status—not just mobility.

- Its buyers are often urban professionals or enthusiasts who treat biking as a lifestyle.

But this model doesn’t translate to scooters. Scooters lack the aspirational aura of cruisers and are seen as functional tools, not emotional purchases.

Strategic Blind Spot

Ola’s misstep lies in assuming that urban tech appeal equals mass-market success. In reality:

- The Indian scooter buyer wants durability, simplicity, and affordability.

- Premium features are nice-to-have, not must-have.

- Should have sold a non-premium (Z-Series Rs 60k) option along with Rs 155k and Rs 125k option. Give the customers a choice.

- Ather Energy understood this and pivoted from premium to budget-friendly with the ₹76,000 Rizta S.

- Earlier Ather too was doing this mistake of selling only PREMIUM vehicles… but with Rizta they were able to lower the price and now with BaaS they have reduced the entry price much more.

The EV scooter market is teaching us a hard truth: brand positioning is fluid.

What starts cheap can become premium, and what begins premium can democratize itself.

The real winners are those who understand the psychology of scooter buyers—giving the customers a choice between an affordable low cost scooter and premium scooter, instead of the choice between 3 premium scooters.

Ola says… if you cannot afford bread…eat cake… or Diamond Head.

We at PlugInCaroo feel DickHead as a project should be SHELVED ASAP… sorry DiamondHead as a project should be SHELVED ASAP

because it doesn’t make ANY sense in having a 5L bike. Rather use that TIME and technology to build a better autorickshaw and car.

Honestly we don’t want a 5L bike… we want an AutoRickshaw with 16inch wheel with great nextGen shock-absorbers to handle our 3rd class City roads … which is SHAMELESSLY full of potholes… and contributes to so many miscarriages and spinal damages.

The car can also borrow from this… see the Chinese car doing the wine glass test and our Mahindra guys faking it… we need to beat the Chinese with our Autorickshaws… not build a 5L dickhead bike that serves no one… sorry was it Diamondhead?

Please connect with me at 8777540355. We need to do some damage control. Everyday is vital.

LikeLike