At first glance, Ola Electric’s recent challenges—delays in product launches, financial losses, and growing market skepticism—might seem like signs of a struggling company. However, a deeper analysis reveals that the reality is entirely different.

Ola Electric is …

not dying; it is undergoing a crucial phase of strategic investments that will secure its dominance in the long-term electric vehicle (EV) revolution.

Misinterpreted Delays: Governmental Roadblocks

One of the major setbacks Ola Electric has faced is delays in its product launches and operations.

However, these delays are not due to inefficiency but rather obstacles created by external agencies, government & regulatory bodies.

Navigating bureaucratic hurdles is often an inevitable challenge for disruptive companies in emerging industries. Ola Electric’s perseverance in overcoming these obstacles signifies its commitment to pushing forward rather than retreating.

Expanding Losses: A Calculated Investment for the Future

Critics often point to Ola Electric’s financial losses as a sign of impending failure. However, this is a misinterpretation of the company’s approach.

Ola is currently engaged in heavy Capital Expenditure (CapEx), investing in multiple vehicle types, battery innovations, and cutting-edge manufacturing infrastructure.

These investments are not wasteful spending but strategic moves to build a strong foundation for the future.

Unlike its rivals, who remain confined to a single vehicle-model with two battery options—Ola Electric is expanding aggressively into more than one manufacturing business of:

1. eScooters

2. Gig Scooters

3. Z-Series Sooters

4. eMotorcycles

5. Li-Ion batteries

6. Li-Ion Storage batteries

7. eRickshaws

This diversification means that Ola will have a more resilient and vertically-integrated product line, catering to a broader audience and reducing risk associated with dependence on a single product. While short-term losses may seem alarming, they are a necessary part of long-term gains.

Usually a manufacturing company is capital intensive and it requires 3-5yrs to become profitable. Ola is expected to turn profitable by the end of this year approx Dec 2025 (4th Year).

In comparison there are companies that are manufacturing eScooters since 10 yrs and still have not seen profit.

Securing a Future-Proof Supply Chain

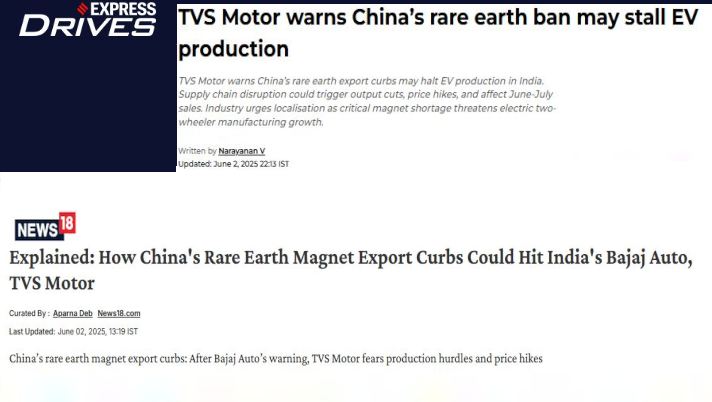

One of the major challenges Ola’s rivals could face is the recent control China has imposed on rare earth magnets. These materials are crucial for electric motors, and reliance on China’s supply chain has left many companies vulnerable.

Ola Electric has developed magnet-less motors for its latest Gen 3 platform. Instead of traditional permanent magnets, these motors use magnetized electrical coils, which improve torque and efficiency while eliminating reliance on rare earth materials.

This approach makes Ola Electric more resilient to global supply chain disruptions, particularly the restrictions China has placed on rare earth magnets.

Conclusion: Ola Electric’s Long-Term Vision

While many might interpret Ola Electric’s current struggles as signs of decline, the reality is that the company is making calculated, strategic decisions to secure its future.

Whether it’s overcoming regulatory challenges, investing in production expansion, or safeguarding its supply chain, Ola Electric is positioning itself as a leader in India’s EV landscape.

What may seem like setbacks now are simply stepping stones towards a larger, more ambitious goal—creating a sustainable and dominant EV ecosystem.

Stepping back for the big leap ahead:

Bhavish Aggarwal’s decision to introduce gaps between Ola Electric’s product launches allows the company to refine production, streamline deliveries, and incorporate customer feedback.

This approach ensures quality control, strengthens market positioning, and prevents operational overload, making each vehicle launch more effective while building a sustainable foundation for long-term success.

Fall in Sales: Market Positioning and Strategic Growth

While some analysts speculate about Ola Electric’s position in the market, the reality is far from concerning.

In May 2025 end the difference in sales between Ola and TVS is only about 4,000 units, while the gap between Ola and Bajaj is even smaller—just 2,000 units.

Such fluctuations are natural in a competitive market, where trends shift from month to month. The competition is dynamic, and small differences in sales figures do not define long-term success.

Being in 3rd position does not indicate weakness—in fact, it reflects Ola’s strong presence in India’s massive two-wheeler industry.

Being No. 3 in a Huge Market like India Is Still Significant

India has the largest two-wheeler market in the world, with millions of vehicles sold annually. Even if Ola Electric were to maintain the third position for ever, it would still command a substantial market share in a rapidly growing EV industry.

Unlike traditional petrol two-wheeler brands that are seeing stagnation and face the threat of further increase the price of petrol, Ola operates in pure-electric mobility space, where future growth opportunities are immense.

Moreover, Ola’s presence in the top tier of EV manufacturers indicates that it is a leading player rather than a fading brand. This strategic positioning ensures that Ola is looking ahead, rather than merely reacting to short-term market shifts.

The company is not just competing in the present—it is shaping the future of electric mobility in India.

In the grand scheme, whether Ola Electric is ranked 1st, 2nd or 3rd in any given month is secondary to the bigger picture.

Ola Electric’s innovation, adaptability, and strategic investments ensure that it remains a powerful force in the industry, with the potential to lead in the long run.