Suzlon Energy has transformed from a debt-ridden company into a lean, growth-focused renewable energy player. With new technology, strong financials, and global ambitions, it is once again positioning itself as a serious contender in the wind energy sector.

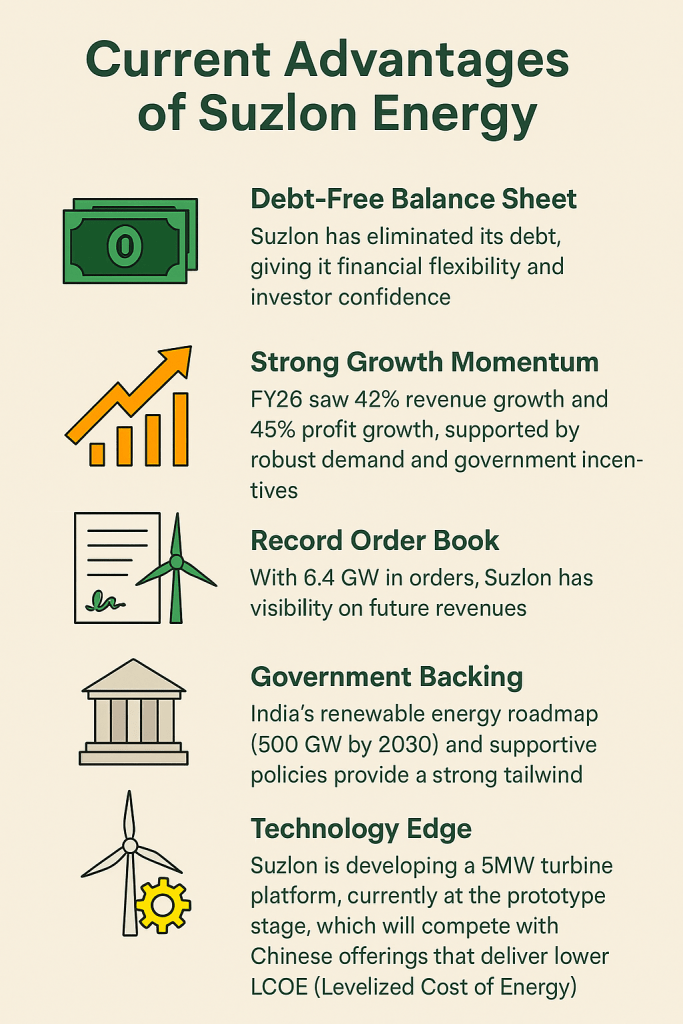

Advantages of Suzlon Energy:

- Debt-Free Balance Sheet: Suzlon has eliminated its debt, giving it financial flexibility and investor confidence.

- Strong Growth Momentum: FY26 saw 42% revenue growth and 45% profit growth, supported by robust demand and government incentives. Suzlon Energy Ltd

- Record Order Book: With 6.4 GW in orders, Suzlon has visibility on future revenues. Suzlon Energy Ltd

- Government Backing: India’s renewable energy roadmap (500 GW by 2030) and supportive policies provide a strong tailwind.

- Technology Edge: Suzlon is developing a 5MW turbine platform, currently at the prototype stage, which will compete with Chinese offerings that deliver lower LCOE (Levelized Cost of Energy). Business Today

- Suzlon has guided for ~60% growth in FY26, with confidence in sustaining momentum into FY27. Business Today

Suzlon’s Europe Expansion Plans

Suzlon’s earlier European foray (via REpower in Germany) collapsed under debt pressures with the onset of Lehman Bros debt crisis. Now, with a healthier balance sheet and advanced turbine technology, Suzlon is considering re-entry into Europe, especially as the India-EU free trade agreement opens new opportunities.

- Europe remains a highly competitive market dominated by Vestas, Siemens Gamesa, and Chinese manufacturers.

- Suzlon’s success will depend on whether it can differentiate with cost efficiency and localized partnerships.

Europe’s Preference: China vs. India

- China: Europe imports significant renewable technology from China, especially in solar PV modules and large-scale turbines (8–10 MW), due to cost advantages. LinkedIn

- India: While India is emerging as a fast-growing clean energy hub, Europe still views Indian firms as secondary suppliers compared to China’s scale. However, India’s rapid growth trajectory is reshaping perceptions, and companies like Suzlon could benefit from Europe’s desire to diversify supply chains. CleanTechnica

Future:

Suzlon Energy today is a story of resilience and reinvention. From debt struggles to a debt-free, growth-focused enterprise, it is now positioned to capitalize on India’s renewable ambitions and Europe’s clean energy transition.

While Europe still leans heavily on Chinese suppliers, Suzlon’s upcoming 5MW turbine platform and strong domestic order book could help it carve out a niche.