For years, India’s EV scooter market was stuck in a tug-of-war between premium positioning and mass affordability. Ather leaned premium-first, Ola chased flashy launches, and Hero MotoCorp cautiously dipped its toes.

Both Ather and Ola had bigger battery packs… well supported by FAME2.

Then Govt pulled the plug… no more FAME2 Subsidies.

Then Govt stabbed entire EV industry in the back… just like Kattappa did… pulled the rug from under EVs feet… Diwali 2025 will always be remembered as PUTIN’s Diwali gift… 10% discount in GST for Petrol Scooters and 0% discount for EV sector. No subsidies for EVs… nothing… NADA… kuch nahi… sampla… baad me jao EVs… kinda attitude.

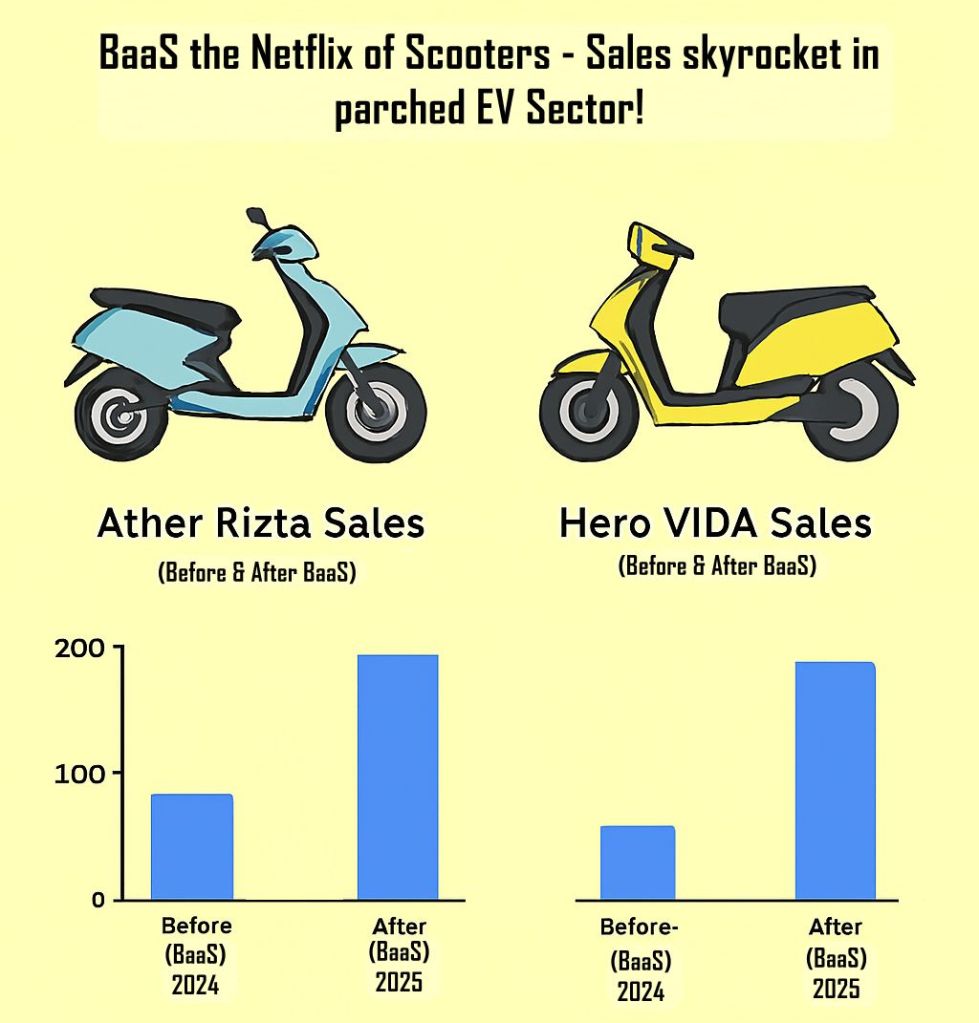

As a result eScooter sales have been flat … first time in decades. The greatest pain was suffered by the electric 2-wheeler industry… and one particularly INNOVATIVE COMPANY… OLA ELECTRIC… Ather and Hero escaped this avalanche because they had early in the year just launched BaaS. Ather was first to introduce it… Hero which is already invested heavily in Ather Energy went along with this technology.

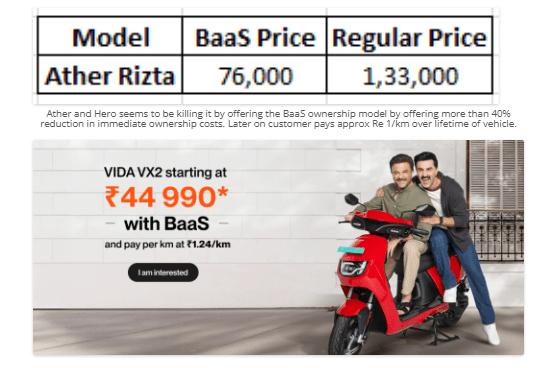

Ather introduced Battery-as-a-Service (BaaS) in India — a scheme that slashed upfront costs, shifted risk, and turned batteries into subscriptions. The eScooter’s weakness became its strength… the expensive Battery now became its strength.

A Rs 156,000 Scooter might seem very expensive for the lower middle class who primarily make up the main scooter customer. But under BaaS the price of Rs 80,000 is deducted from the scooter price and the customer can buy the scooter for just Rs 76,000 and agree to pay at Re1/per km.

Over 20yrs the scooter might do over 2,00,000 kms and earn the company Rs 2,00,000 in BaaS revenue.

The batteries will earn at least 3 times more over the lifetime of the scooter that the scooter itself. Suddenly, scooters weren’t just vehicles; they were annuities on wheels.

Before BaaS: The Premium Trap

- Ather Rizta: Sold ~1.1–1.5 lakh scooters annually before BaaS, struggling to break into mass affordability.

- Hero VIDA: Hovered at ~6,800 quarterly sales, holding just 6.8% of the EV market.

- Consumer hesitation: High upfront costs and battery replacement fears kept buyers cautious.

Why BaaS Works

- Lower upfront cost: Scooters became cheaper than petrol rivals like Honda Activa.

- Buyback guarantees: Up to 60% resale value reduced consumer risk.

- Extended warranties: 5-year coverage boosted confidence.

- Recurring revenue: Subscription fees turned one-time sales into long-term cash flows.

Ather and Hero have turned scooters into streaming services on wheels. You don’t buy the battery; you subscribe to it. Instead of binge-watching shows, you binge-ride kilometers.

The upfront cost is low, but the recurring bill keeps rolling — much like your monthly OTT subscription.

The difference? BaaS subscription comes with wheels, warranties, and a resale guarantee.